Turning around struggling ventures

We help corporates to quickly gain transparency on their ventures‘ business

potential and help to plan and execute a potential turnaround

The Problem

The Problem

Over the last years, many corporates have significantly invested in generating new business beyond the core by building corporate ventures and investing corporate venture capital. However, a lot of these ventures fall short of expectations or are even endangered by liquidation.

The Reasons

Reasons for failure are multifaceted. While corporate venturing remains a higher-risk asset class with success rates between 20%-60% on a portfolio level, we often observe evitable mistakes on a venture level. Some typical examples are procrastination of much-needed business model pivot, the inability to leverage the corporate’s unfair advantage, lack of suitable talent, or no clear go-to-market approach with missing focus to fill the sales pipeline.

The Reasons

Reasons for failure are multifaceted. While corporate venturing remains a higher-risk asset class with success rates between 20%-60% on a portfolio level, we often observe evitable mistakes on a venture level. Some typical examples are procrastination of much-needed business model pivot, the inability to leverage the corporate’s unfair advantage, lack of suitable talent, or no clear go-to-market approach with missing focus to fill the sales pipeline.

The Solution

A detailed view from the outside with a structured analysis helps to identify the underlying factors for the challenges. Leveraging our experience as a corporate venture builder, we have developed a field-tested 3-step approach to help corporates turn around their struggling ventures:

The Solution

A detailed view from the outside with a structured analysis helps to identify the underlying factors for the challenges. Leveraging our experience as a corporate venture builder, we have developed a field-tested 3-step approach to help corporates turn around their struggling ventures:

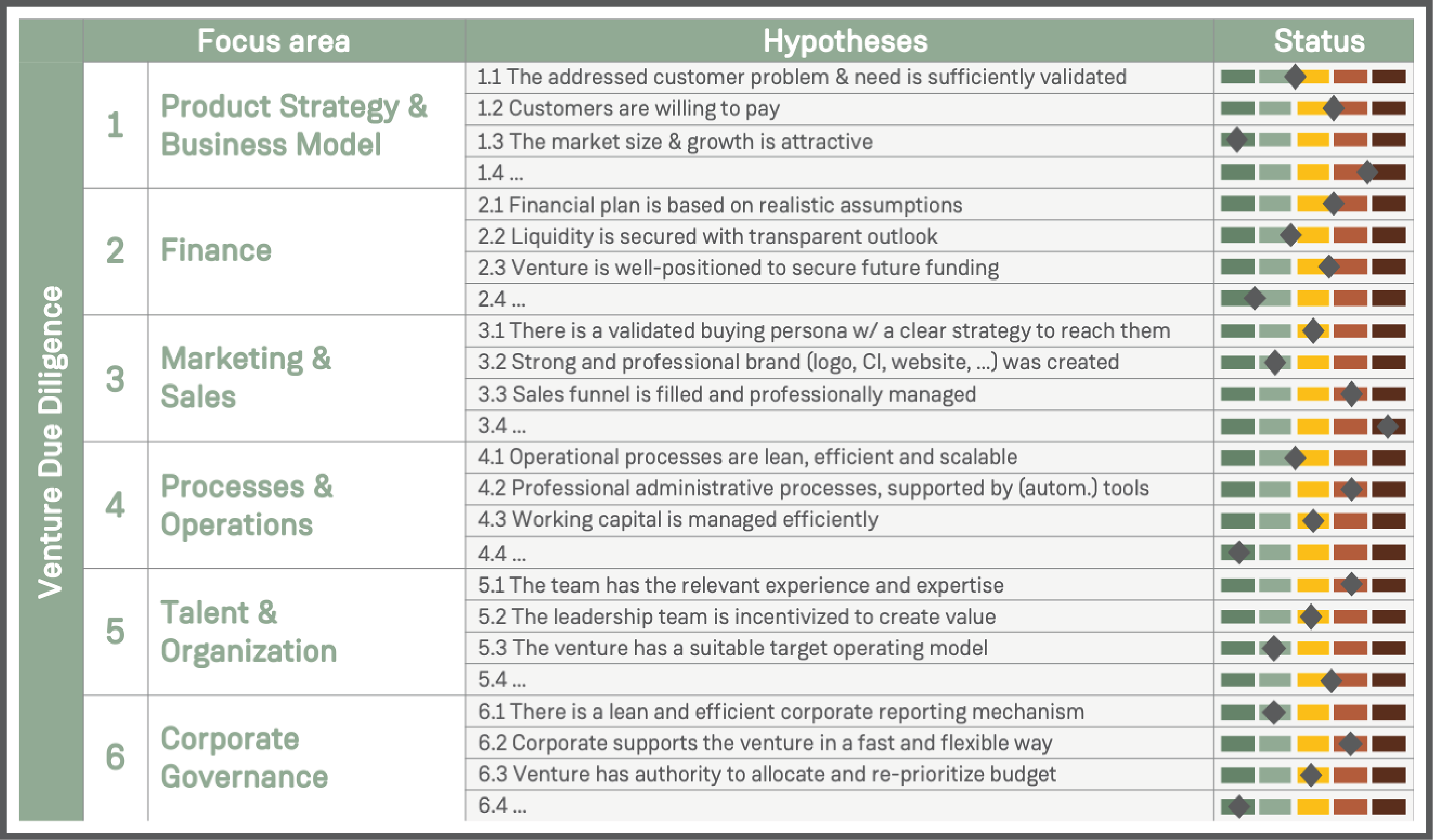

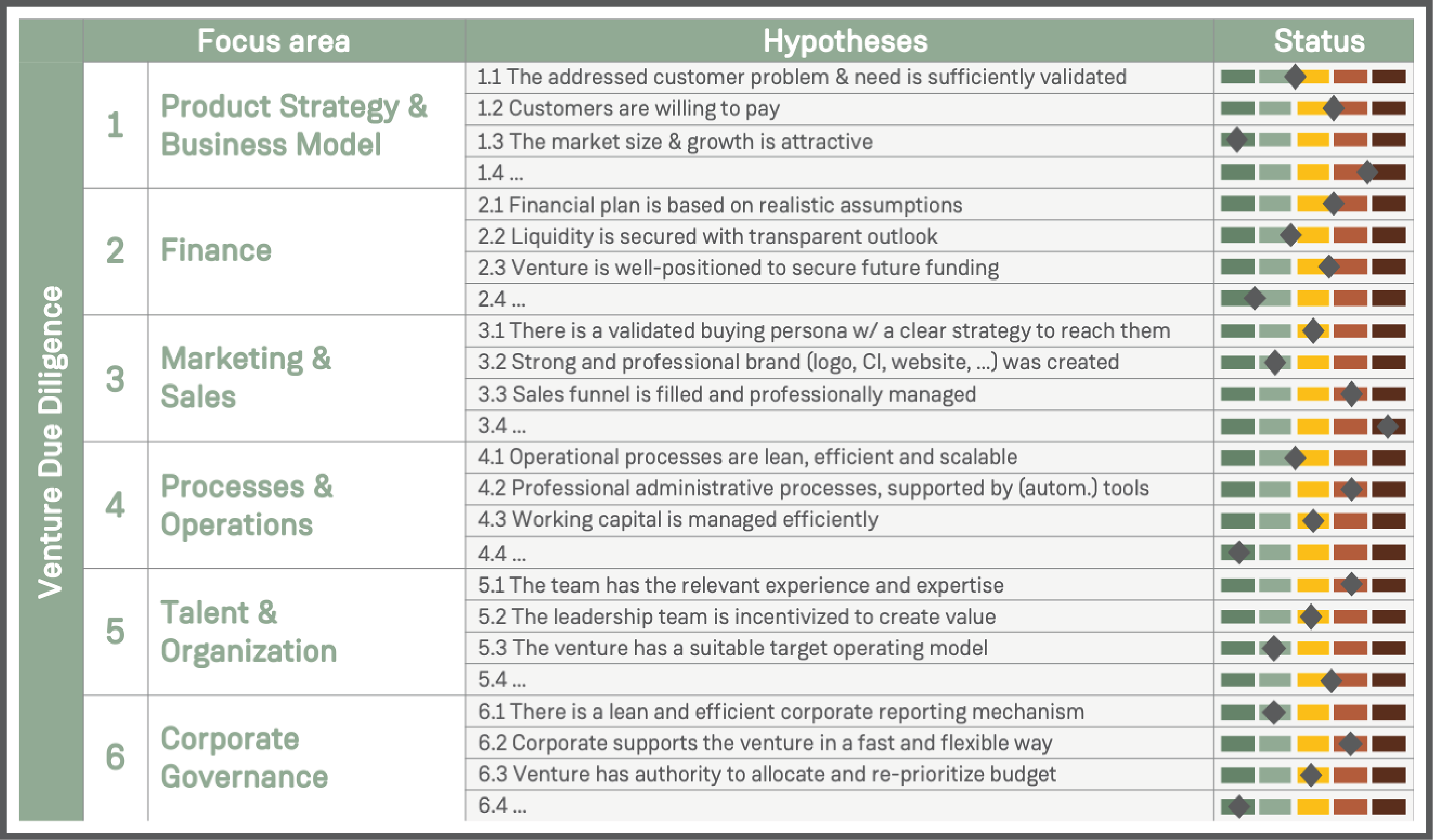

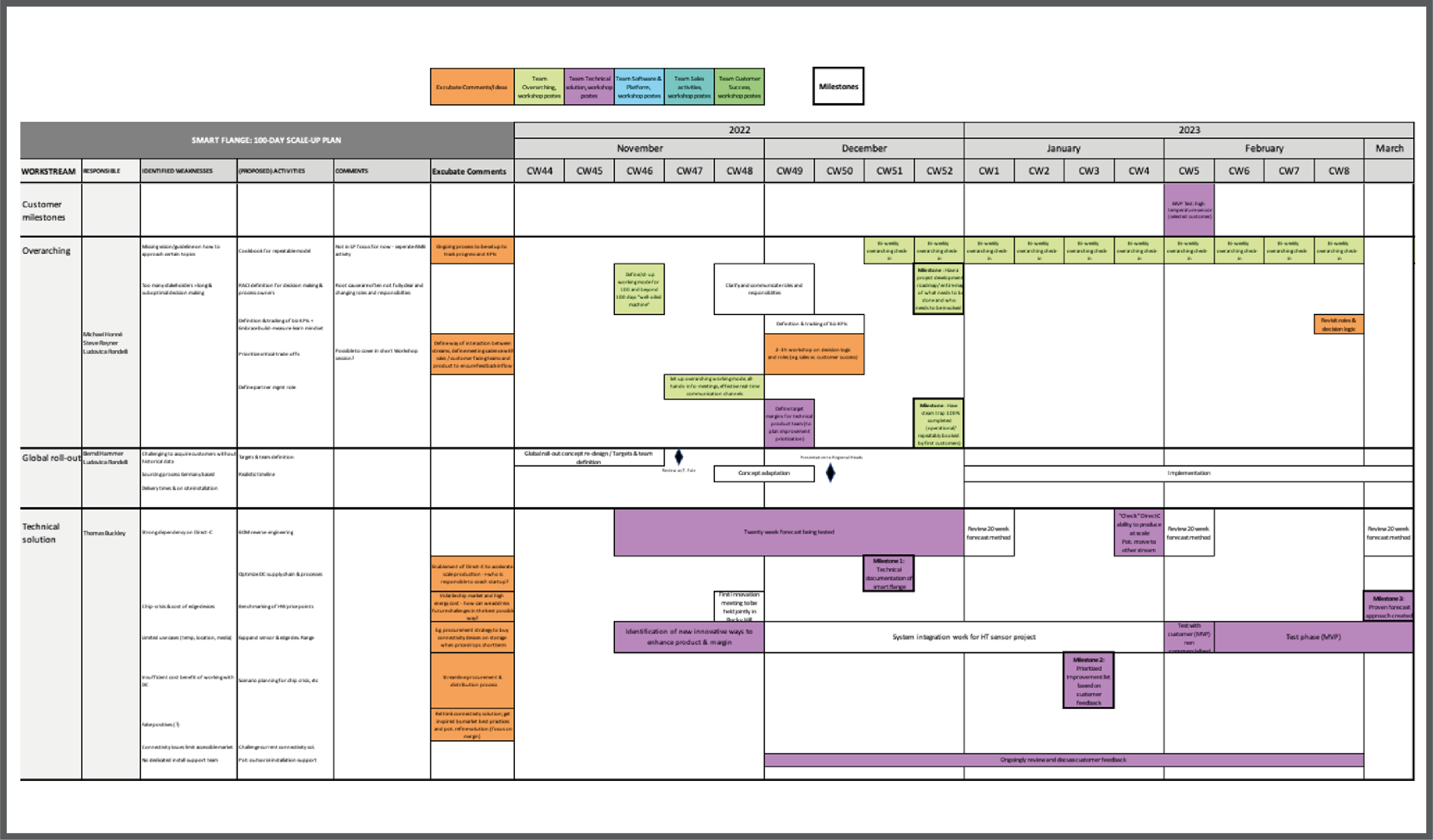

1. Venture due diligence

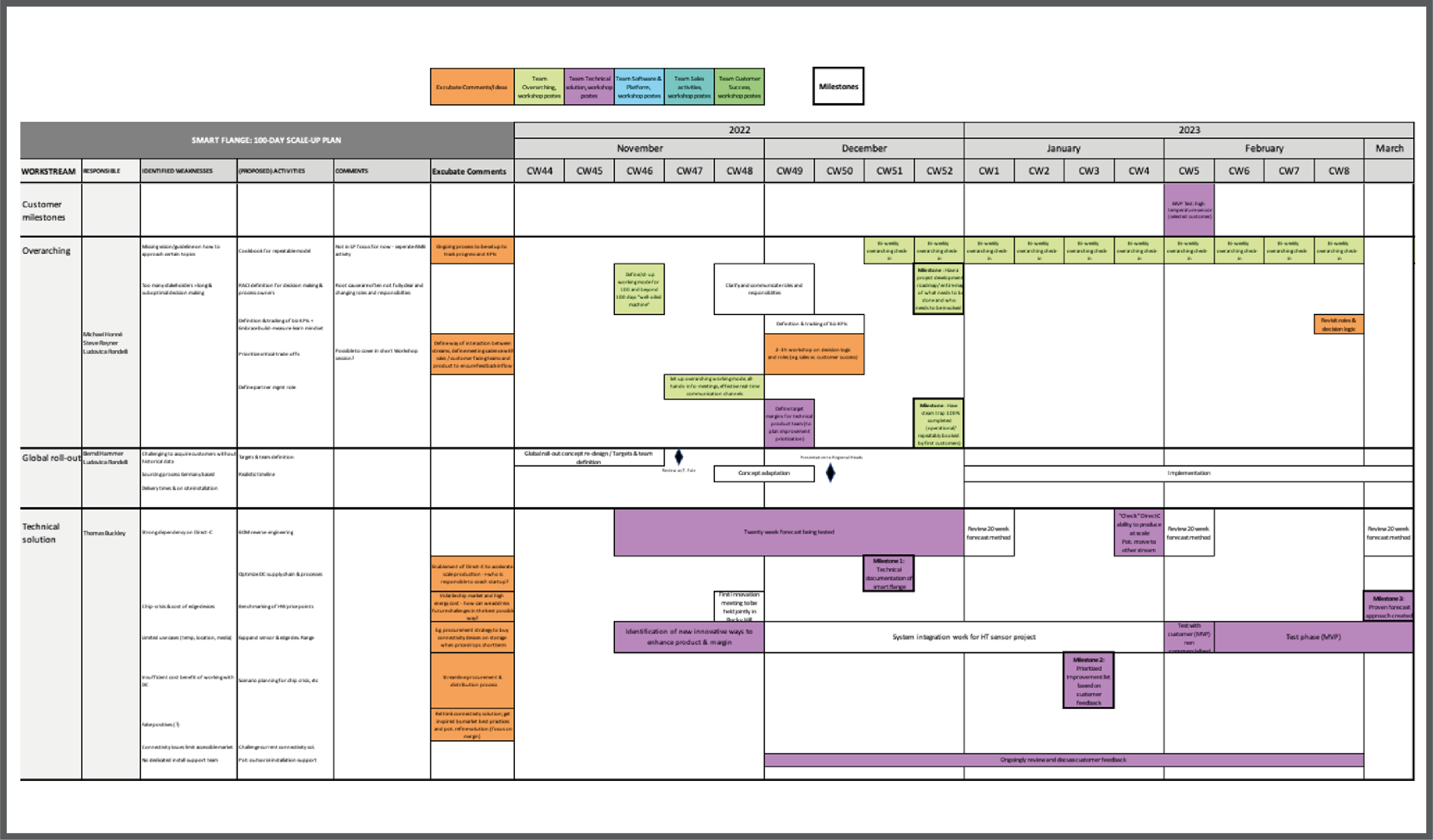

2. Turn-around roadmap

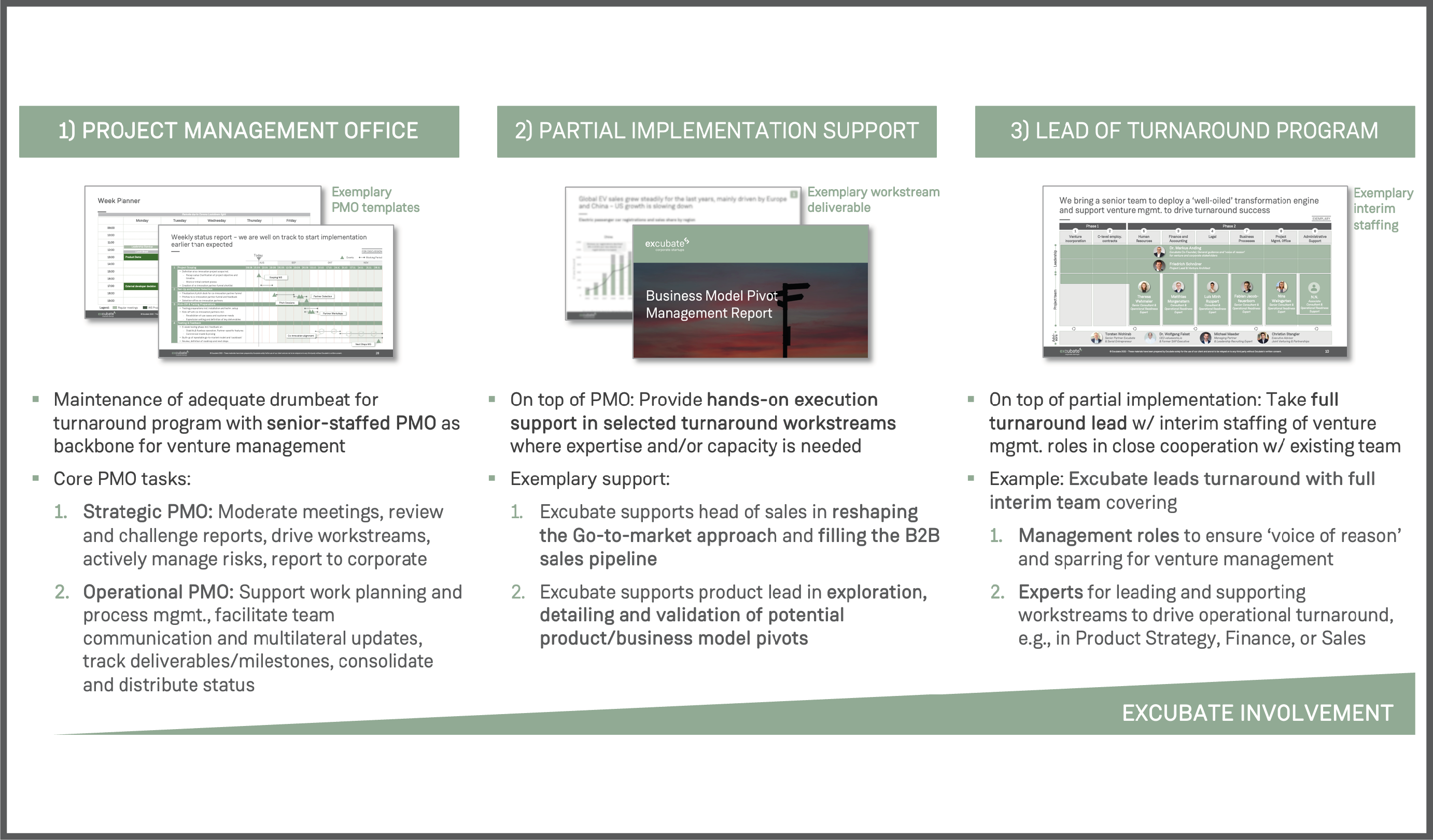

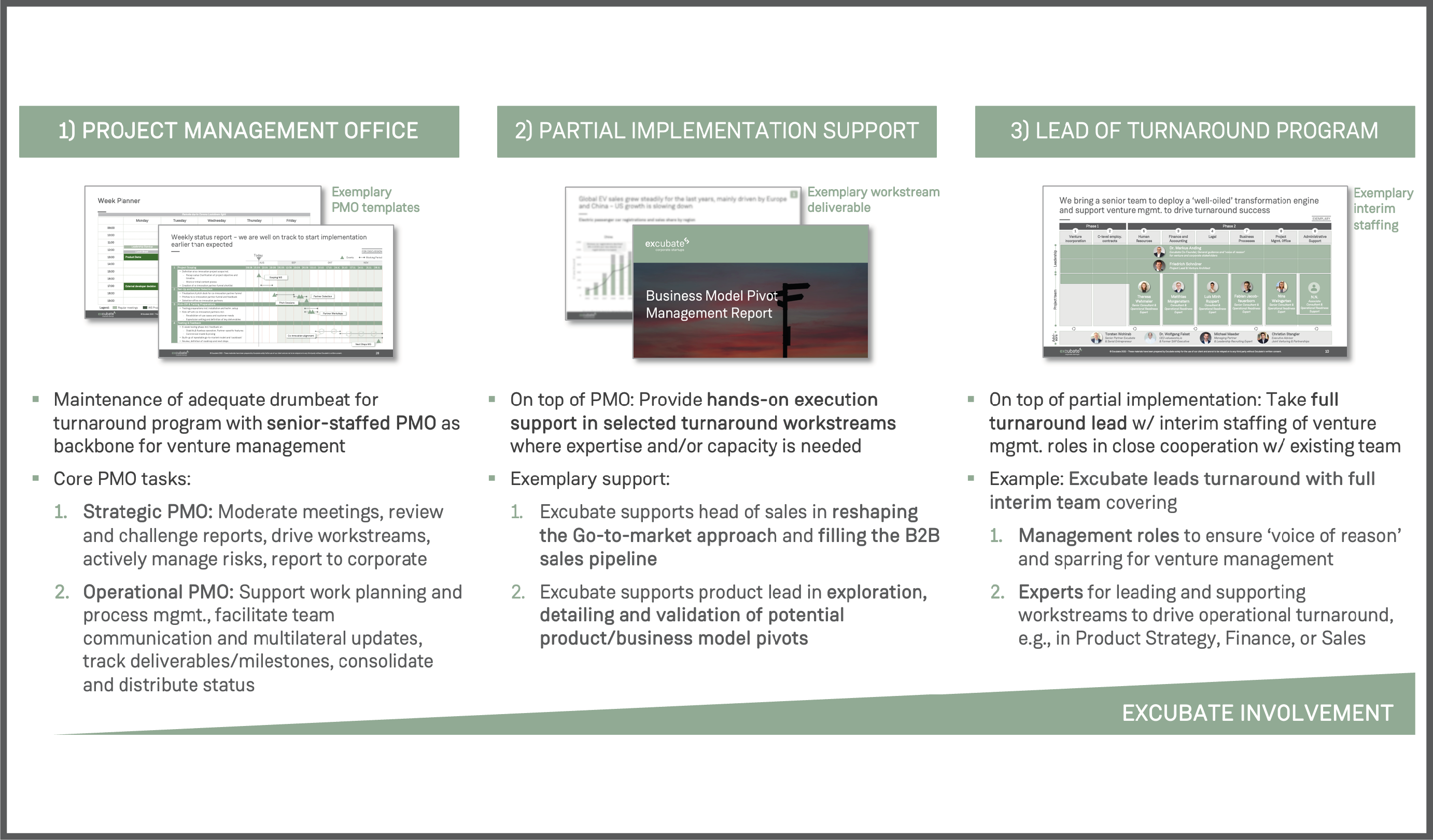

3. Implementation support

1. Venture due diligence

2. Turn-around roadmap

3. Implementation support

The Outcome

With our approach, we identify the most-urgent challenges and help you implementing the changes needed. This results in transparency on the venture’s business potential for the corporate and a well defined way forward for the venture mgmt.

The Outcome

With our approach, we identify the most urgent challenges and help you implementing the changes needed. This results in transparency on the venture’s business potential for the corporate and a well-defined way forward for the venture mgmt.

After completion of due diligence and roadmap, we have:

- Assessed the ventures’ business potential

- identified the most urgent venture challenges

- Validated and prioritized potential turnaround levers

After execution of the 100-day plan we have:

- Mapped a clear way forward with focus on the next 100 days

- Implemented the most pressing turnaround initiatives

- Defined proof points for a successful turnaround

After supporting you with the implementation we have:

- A clear and actionable way forward on the next 100 days

- Defined detailed deliverables, workstreams and milestones

- Identified the most challenges and initial solutions beyond the 100 days / rough planning of milestones

After completion of due diligence and roadmap, we have:

- Assessed the ventures’ business potential

- Identified the most urgent venture challenges

- Validated and prioritized potential turnaround levers

After execution of the 100-day plan we have:

- Mapped a clear way forward with focus on the next 100 days

- Implemented the most pressing turnaround initiatives

- Defined proof points for a successful turnaround

After supporting you with the implementation we have:

- A clear and actionable way forward on the next 100 days

- Defined detailed deliverables, workstreams and milestones

- Identified the most challenges and initial solutions beyond the 100 days / rough planning of milestones

What about your venture?

Free call

We offer a result-oriented discussion of your venture or business model in a 30min call.

Preliminary analysis

We are also happy to do a free preliminary analysis in the run-up to the call to work out some initial hypotheses.

Get in touch with us

Torsten Wohlrab

Sent us an Email

What about your venture?

Free call

We offer a result-oriented discussion of your venture or business model in a 30min call.

Preliminary analysis

We are also happy to do a free preliminary analysis in the run-up to the call to work out some initial hypotheses.

Get in touch with us

Torsten Wohlrab

Sent us an Email