Key messages

- Your value chain is not enough: Disruptive innovation can hit established companies from far beyond their own industry

- Now or never: The upcoming downturn may further widen your innovation gap vs. startups – if innovation is put on the backburner in these game-changing times

- It’s not that hard: Ingredients for success are all there, they just need to be worked with in a different way

- Divide and conquer: Excubating the new from the old enables both to thrive

- No unicorns, no bunnies: Sober innovation portfolio management trumps big bets and actionism

- The entrepreneur is the pioneer is the orchestrator: CxOs need to adopt a Chief Entrepreneurial Officer mentality and become “leaders of the future”, playing three dedicated roles

The existential question: Digital Disruption – Friend or Foe?

Every traditional company (and as such, their management team) is currently facing an existential question: How to address digitalization and disruption and not only survive the respective challenges, but also take advantage of the massive opportunities coming along with them?

It’s easy to get scared in the face of what’s coming, especially out of the startup world. This is particularly challenging for companies in low-tech industries (e.g. food, textiles, services…) that, by nature, exist in a bigger distance to digital technologies. Let’s take an example from the food industry: Tyson vs. Beyond Meat.

Tyson is a big meat producer in the U.S., with revenues of around $40B and a $24B market capitalization. Tyson has been recently taken on by Beyond Meat – a (still) startup providing meat-like, vegan food products to people who love meat, but also want to eat vegetarian. With only about $80M revenues in 2018 (0.2% of Tyson), Beyond Meat already commands a $13B market cap (50% of Tyson), which highlights the belief of the market in the future potential vs. established players like Tyson. Despite the recent triple-digit revenue growth, Beyond Meat will remain tiny compared to Tyson, at least for a while. Tyson also had invested into Beyond Meat, but sold its stake and is now establishing an own plant-based meat line Raised and Rooted, results to be seen.

The economic downturn will likely widen the gap, as more and more traditional industry players miss the innovation boat

Whether digital disruption becomes one’s friend or foe depends on what established companies make of it – and how they handle situations of ambiguity, such as an upcoming economic downturn.

In the traditional view, industry players were all in the same boat: An economic downturn forces one to reduce innovation spending? All industry competitors follow suit, reducing their spending too. In sum, little damage was done to their long-term market positioning.

Now, there are two new players in the boat, to whom this rule does not apply: Heavily financed startups (see Beyond Meat) and state-backed companies dedicated to taking on an existing market. For these players there is no downturn – and with incumbent companies standing back, they can aggressively grab market shares (think about the German solar industry pattern).

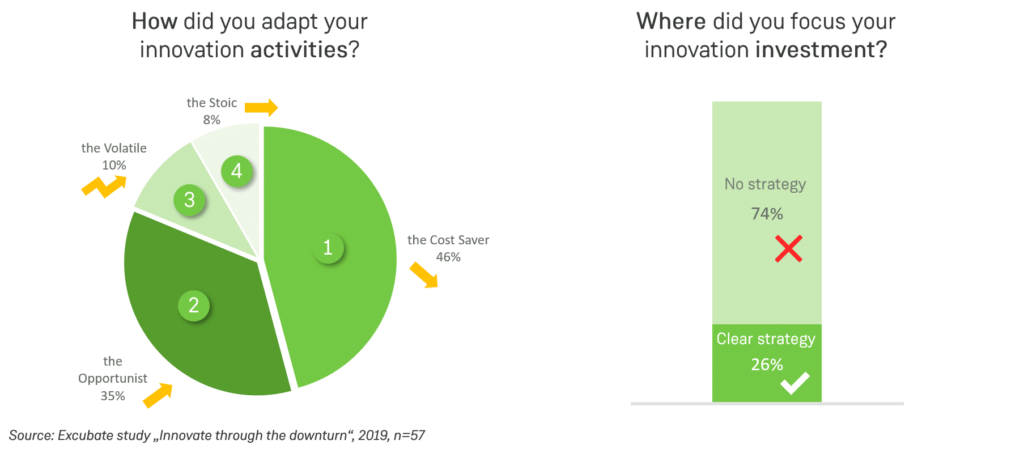

Based on insights from a recent Excubate study on “Innovating through the downturn”, only a few established companies have a clear plan for how to handle innovation activities. While almost 50% take an undifferentiated cost cutting approach and just stop spending (“The Cost Saver”), others (35%) are more opportunistic and selectively increase innovation spending, while hoping to pick the relevant innovation opportunities (“The Opportunist”). Other companies either don’t change anything during a downturn (“The Stoic”) or are very unclear about investing/not investing (“The Volatile”).

More concerning, however, is how companies go about selecting their innovation investment: For the most part they don’t have a clear strategy for where to put their focus: Short vs. long-term benefits, close vs. far from core business, financial vs. non-financial impact. The number of companies struggling with this decision-making process is staggering – according to our research, 74% of companies don’t have a clear understanding of what they are optimizing for when spending on innovation during a downturn.

In light of these dynamics, it is very likely that the classic cost-reduction approach will hurt companies much more than it had done in past downturns and may even pose an existential risk to some players if they just sit and watch stoically how their business model gets disrupted. Traditional industries are particularly endangered, as their management often reverts to behaviors that worked in the past and fails to see how the underlying competitive dynamics have changed.

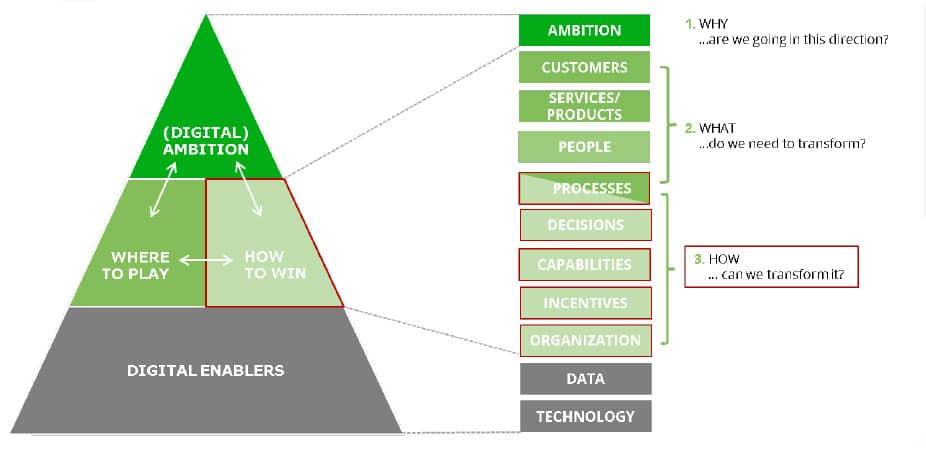

To take on this challenge and make digital disruption a friend rather than a foe, three questions are important for traditional industry players to get right: What, How, and Who to innovate.

The What: Look in the right place – beyond your own industry

Looking at traditional approaches to innovation, all seems very simple: Run a few design thinking workshops to understand your immediate customers better, scope out a few incremental or disruptive ideas, prioritize and validate, maybe even implement some of them.

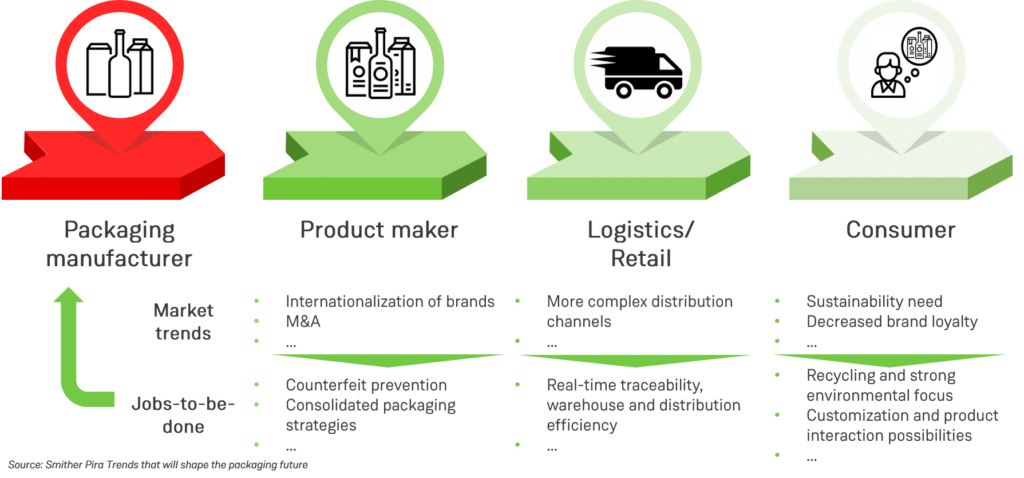

Considering a traditional industry, for example the packaging industry, the immediate market trends for each player in the value chain and the respective jobs-to-be-done for packaging manufacturers are actually well understood. For example, the internationalization of product manufacturers and more complex distribution channels lead to requirements like prevention of counterfeiting and real-time traceability. Most companies have strategy and business development departments tackling these topics and implement solutions – with varying results.

This traditional approach, however, is not effective at addressing real disruption risks.

Disruption often comes from unexpected angles, that – by nature of looking into a single industry – are rarely on the radar of strategy or business development teams who are too focused on their own market and close adjacencies. It is often innovation in a separate industry, however, that brings beneficial, detrimental, and often unintended side-effects.

A few interesting examples from non-adjacent industries impacting the packaging industry include 3D pill printing, real-time pizza delivery and home-grown food:

- $18B global medical blister market: Pharma companies experiment with 3D pill printing; with patients filling their prescription right at their homes, much fewer blisters and other pill packaging is needed

- $2.3B global market for pizza boxes: U.S. startup Zume now bakes pizza while it is being delivered to customers, serving them directly off the truck on a reusable tray – no box needed

- $83B global food packaging market: Startups provide help and guidance with growing own food, using app support

Thus, it is an imperative to look beyond immediate industry adjacencies and closely monitor what is happening in other industries to identify potential disruptions from various sides – and benefit from respective business opportunities. Other examples like the automotive industry, where ownership of the customer inside the car is taken over by, e.g. Apple Carplay, further highlight that merely looking up and down the value chain will strongly limit the perspective on disruption threats and opportunities, leaving companies vulnerable.

The How: Use what you have in a different way – Excubation

Once disruption occurs, traditional companies often react with paralysis, and then panic, mostly reverting to traditional innovation behaviors. When telco SMS revenues were disrupted by WhatsApp in 2009, the approach was to copy it and try to build a better one. This, however, resulted in an overengineered solution, taking 2 years and endless funding only to end up not having a chance against the disruptor who had gathered 500M users by then.

While, in the traditional, non-digital space, the incumbent would have had the chance to mobilize and outmaneuver a disruptor with its sheer resources in the scaling phase, digital innovations enjoy substantially faster global scaling, leaving little chance for followers to catch up.

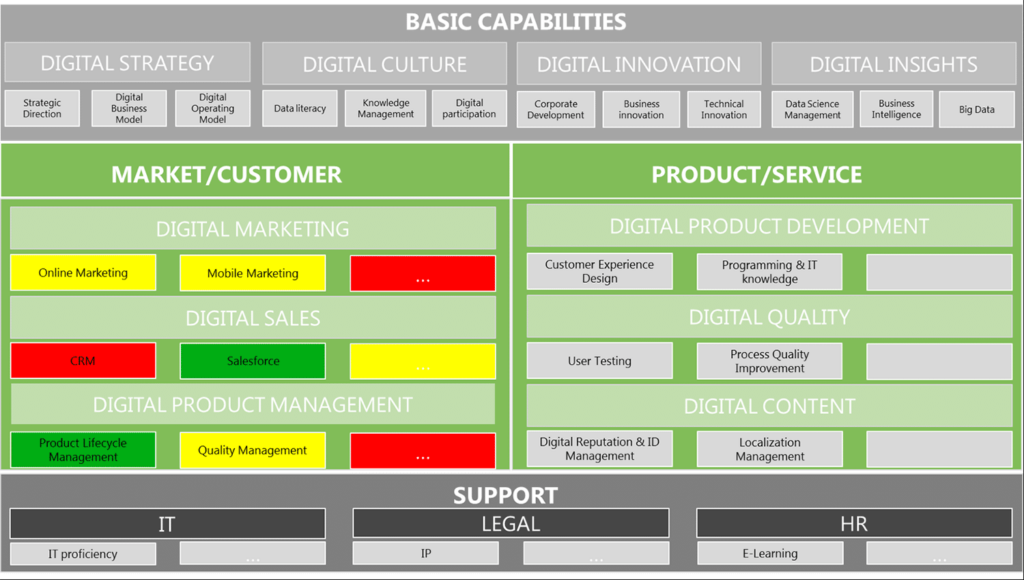

The good news for traditional industries is that they do possess most ingredients for successful digital innovation, some in vast excess, compared to startups: Smart people, good ideas, access to customers, financial and technological resources, patents, etc.

It is merely the approach to using and combining these resources that must be fundamentally revised.

Despite all the behaviors engrained in traditional corporate culture and massive organizational inertia, companies must adopt the startup-way of doing things, as only that will eventually ensure sufficient speed, focus and nimbleness. And despite all reassurance of corporate management, that this isn’t possible: It is possible. Almost more importantly, the existing resources (unfair advantages over startups) need to be leveraged thoughtfully and effectively to create a strong competitive advantage.

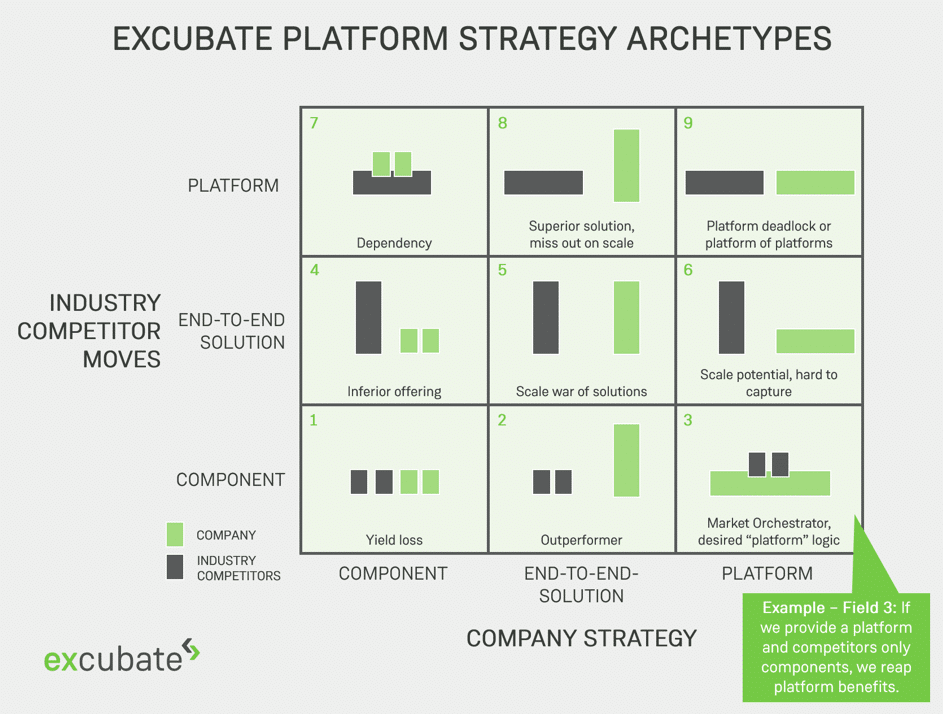

There are three levels on which digital innovation needs to be approached differently: Company level, innovation portfolio level, and individual innovation level – all of which we want to briefly touch upon and provide a quick intro to.

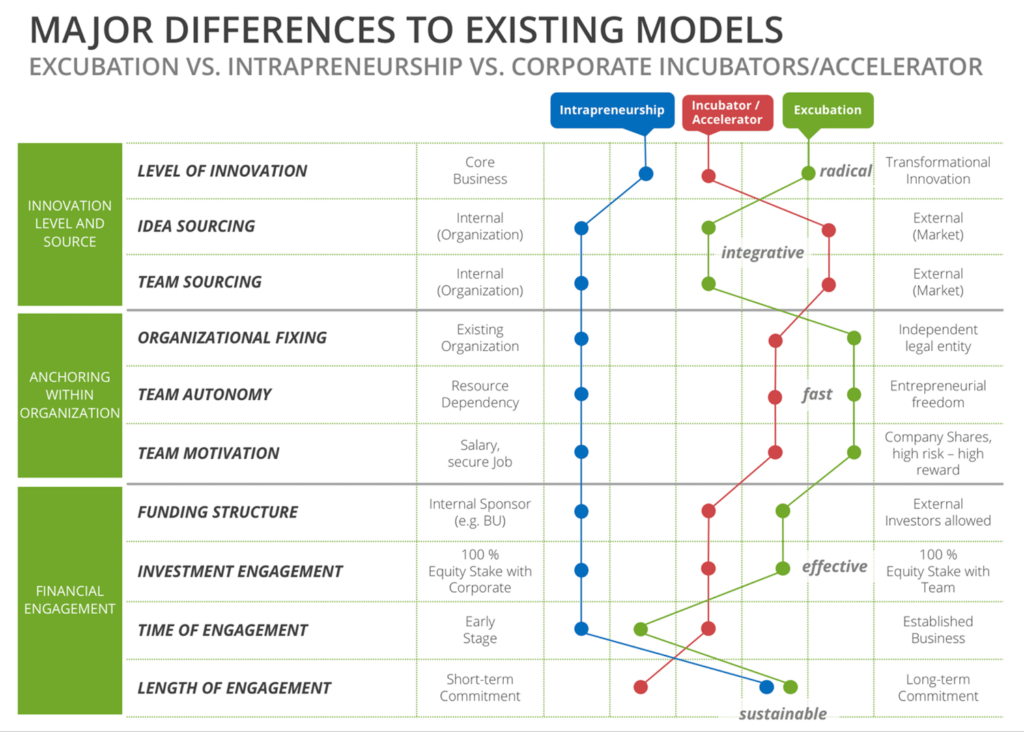

Digital innovation on company level: The Excubation model

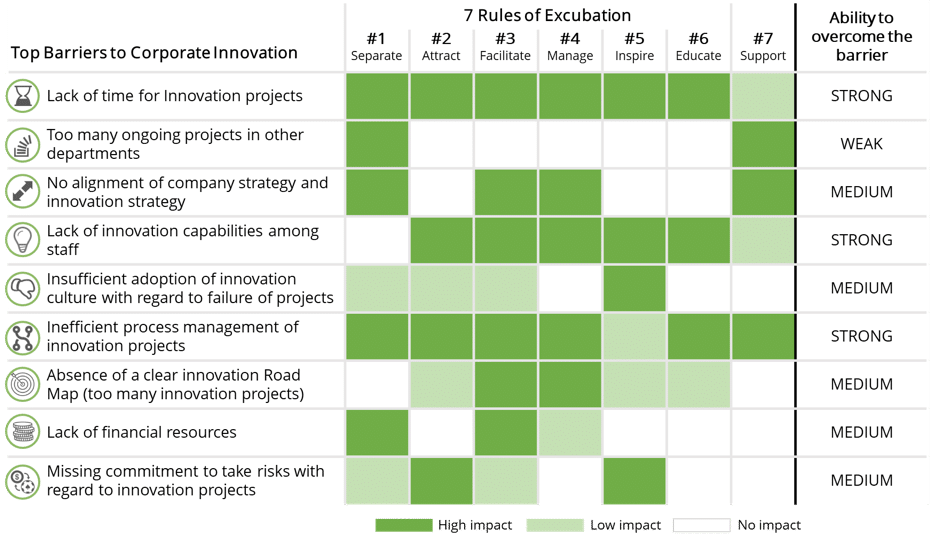

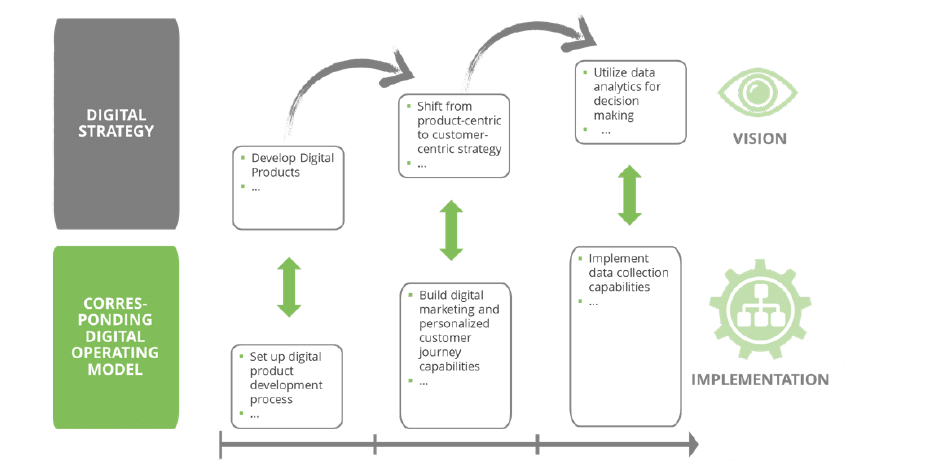

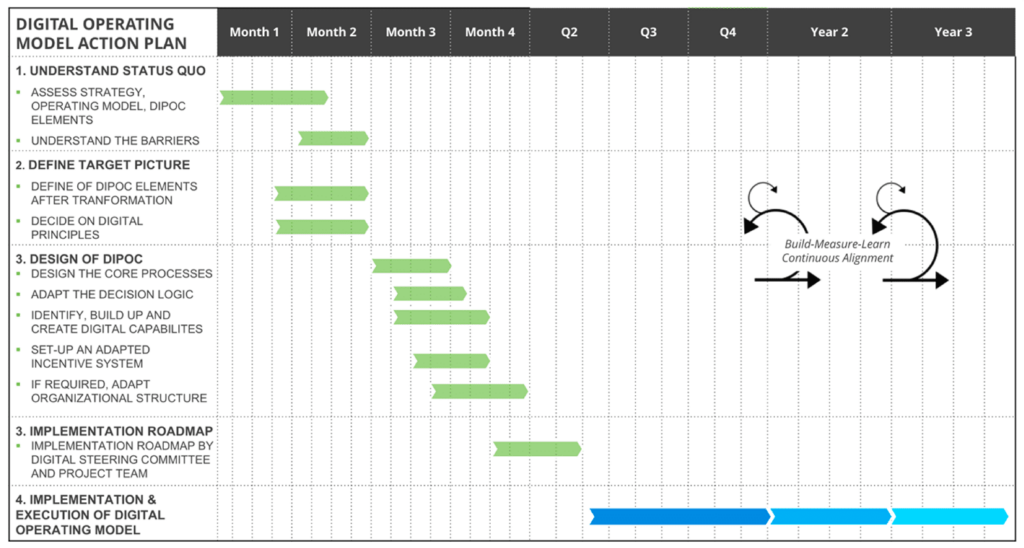

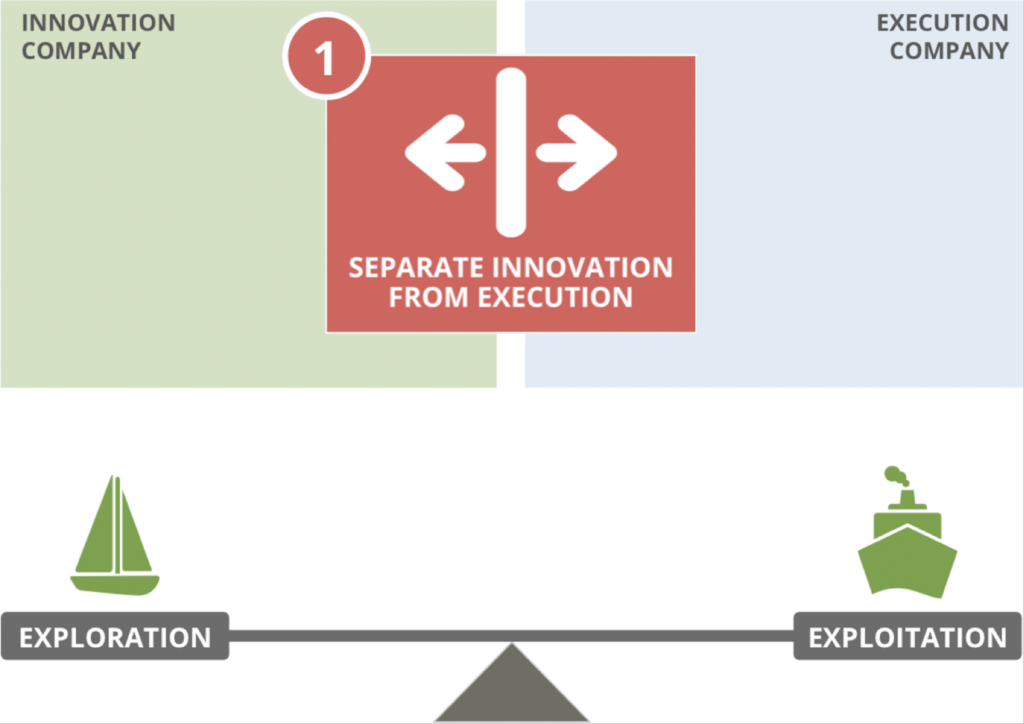

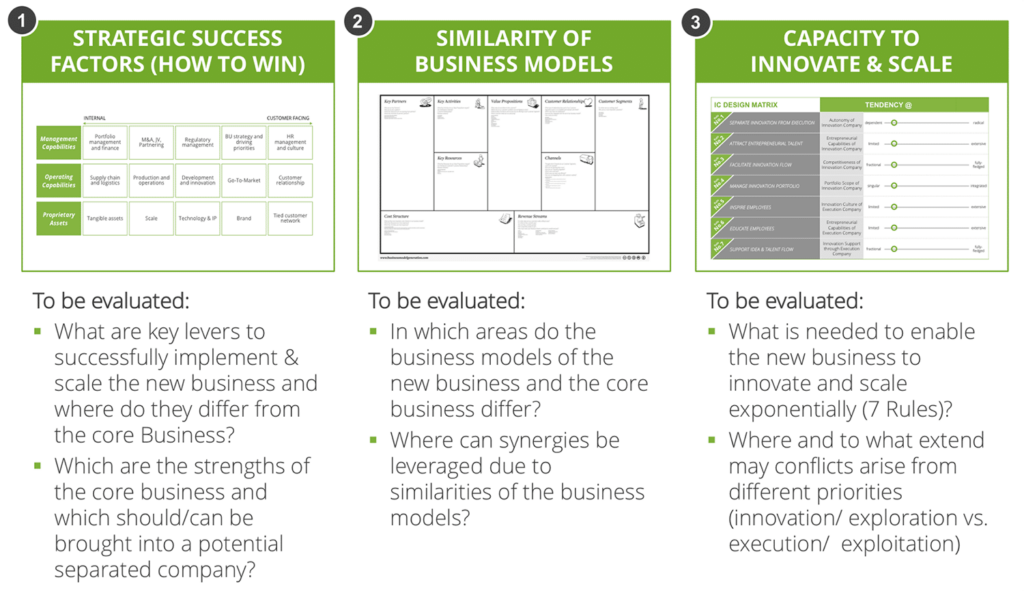

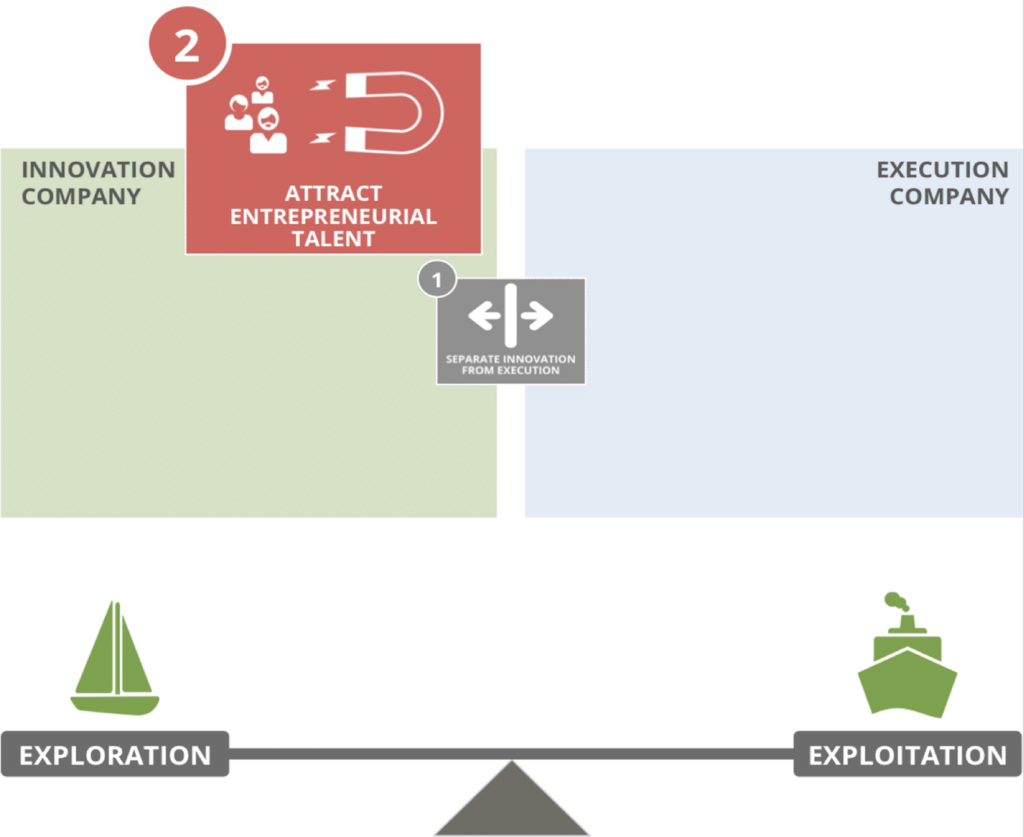

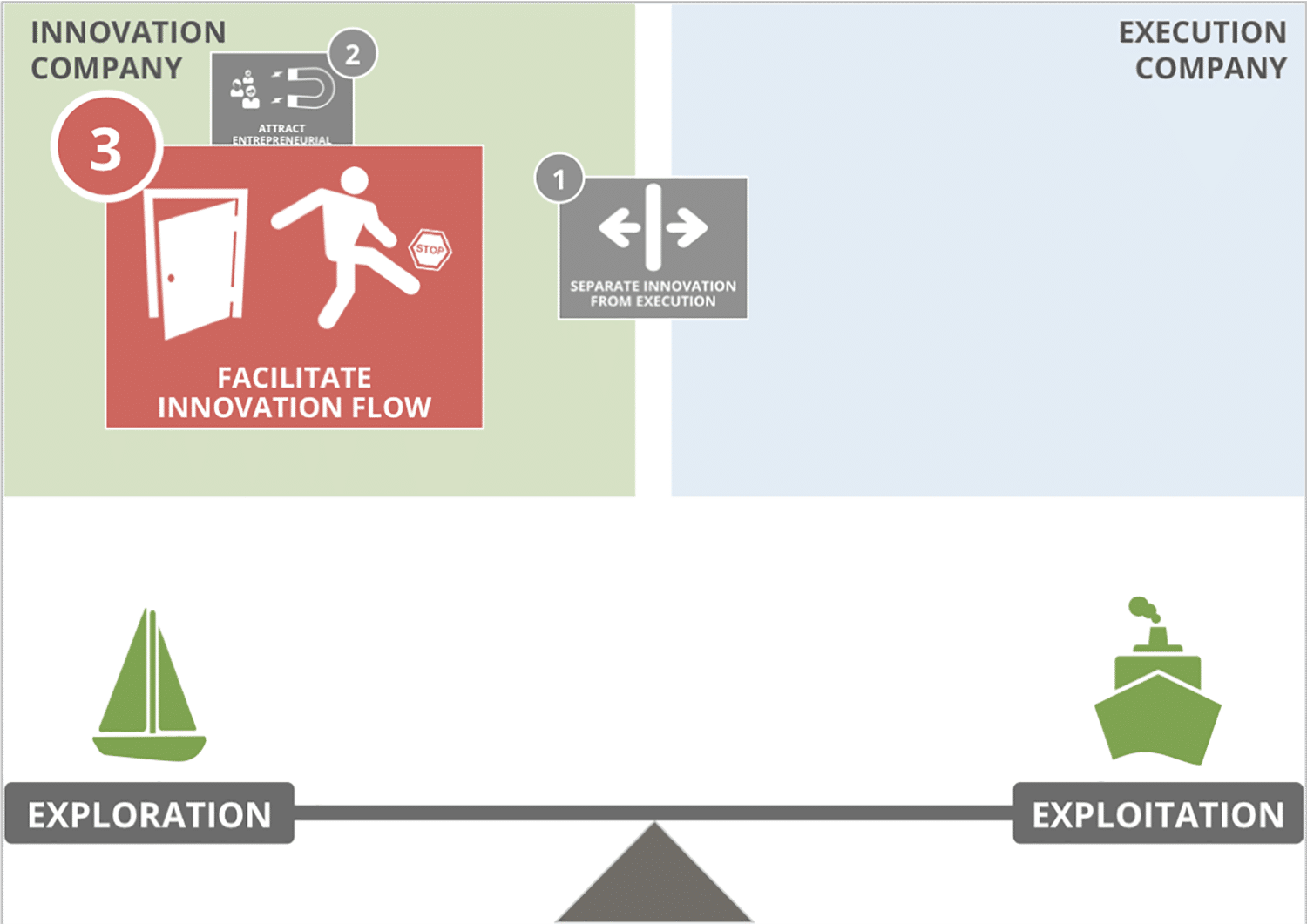

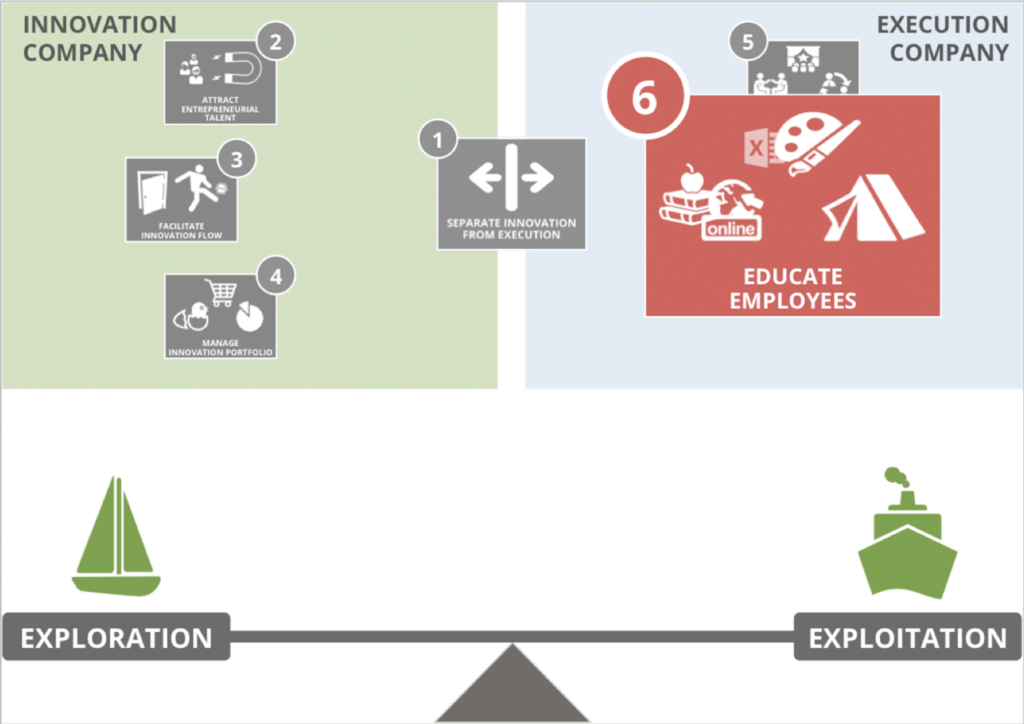

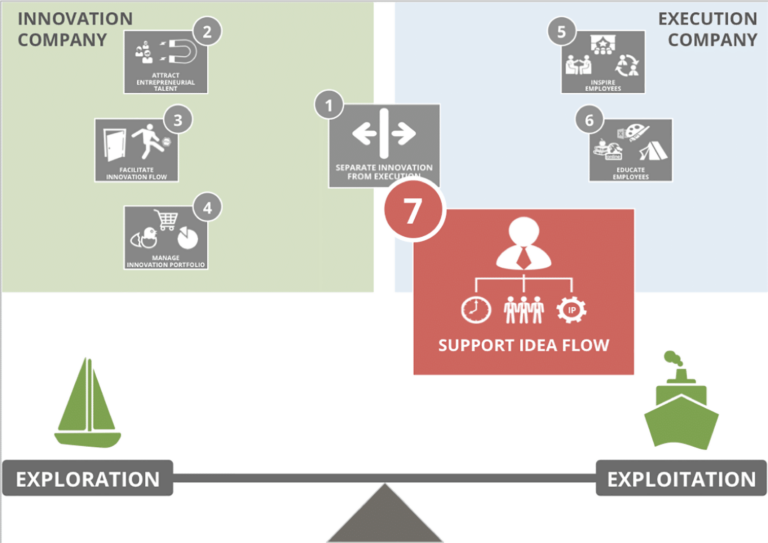

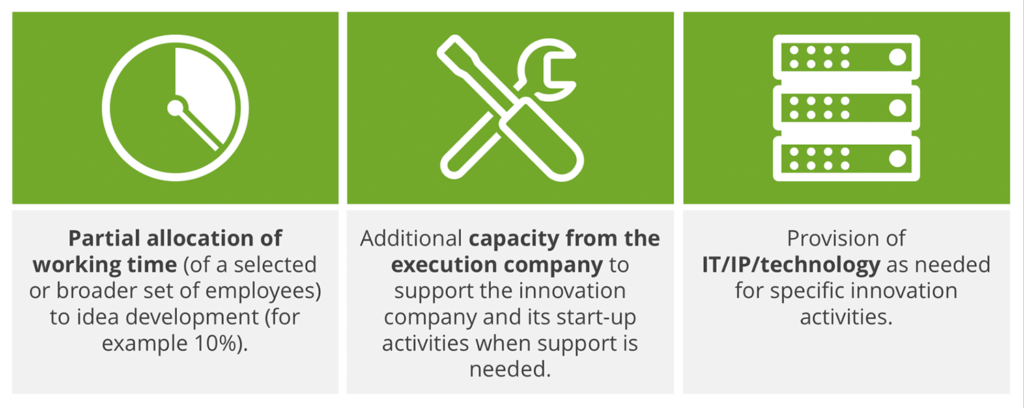

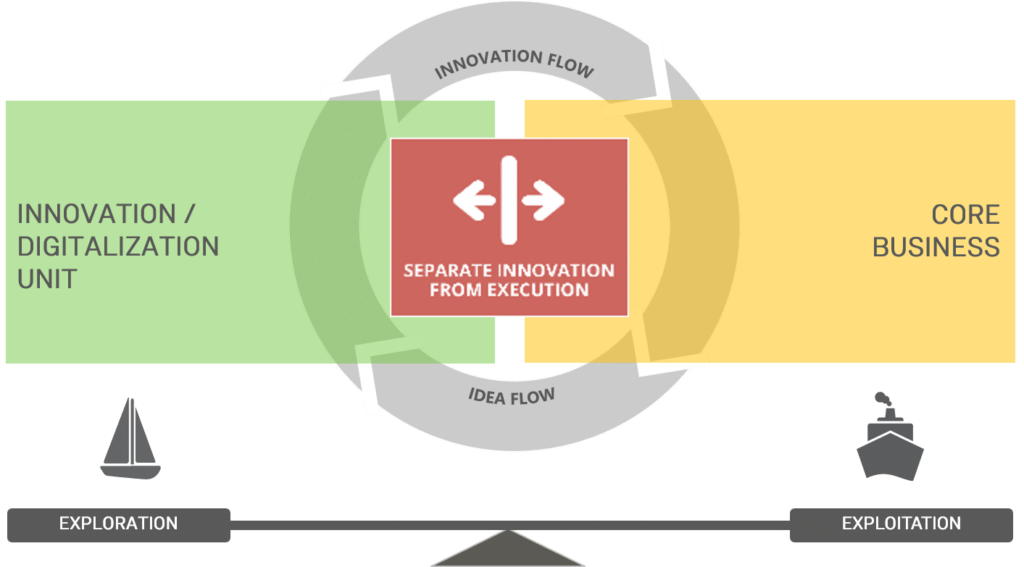

The Excubation model enables a new way of innovating by separating innovation from the core business, while retaining selective linkage to the core to ensure best possible access to the right resources. An innovation unit will be tasked with identifying, building and scaling digital innovations and business models. It is critical to smartly separate the innovation unit from the core, such that fast and autonomous innovation can happen while customers, technology, and supporting resources of the core business can be accessed swiftly.

This not only requires a thoughtful setup of the innovation unit, but also enablement from within the core, e.g. in educating employees, setting respective incentives and fueling the innovation unit with people, ideas and resources.

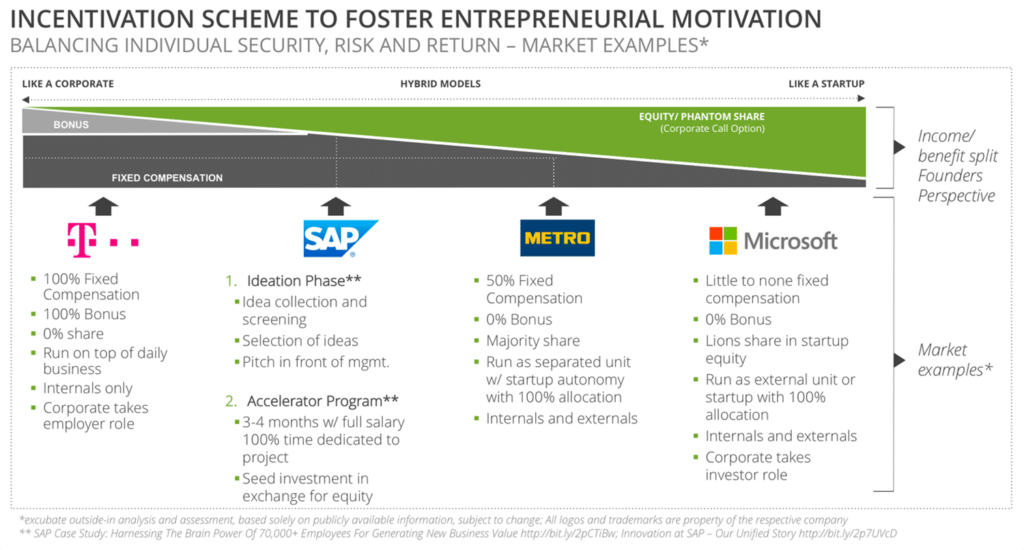

Key activities in the innovation unit include managing the innovation portfolio, facilitating the innovation flow, developing the respective innovation methodologies and processes as well as attracting and retaining internal and external innovation talent.

A more thorough introduction to the Excubation model is provided here:

Excubate - Corporate Innovation needs a major makeover

Digital innovation on the portfolio level: No unicorns, no bunnies

Managing a reasonable innovation portfolio is a key enabler for digital innovation success. Yet there are still many companies either trying to find the unicorn innovation to save their business for the next 20 years, or running after a large number of small innovations (bunnies) that individually don’t have much to contribute, but trigger much management effort and disperse the focus.

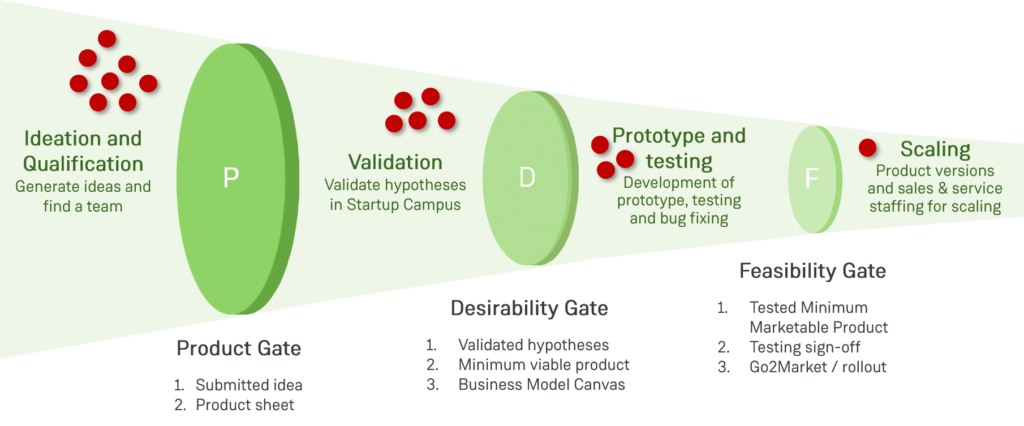

The innovation funnel and respective evaluation and decision criteria should be designed such that a portfolio of 10-15 digital innovations is being managed at any time, each innovation with the potential to contribute tangible business volume, but not too big to make the company fully dependent on it. A funnel logic like the one depicted below typically works very well.

While digital innovations shouldn’t be measured based on quarterly financial results, a minimum financial perspective must be reflected among the funnel criteria at all stages. It still happens too often that companies explicitly neglect financial KPIs and focus mostly on building digital capabilities and practicing new working modes. These – no doubt – are also key innovation objectives from a corporate perspective, but don’t necessarily put sufficient momentum on individual innovations to force success vis-à-vis disruptive startups.

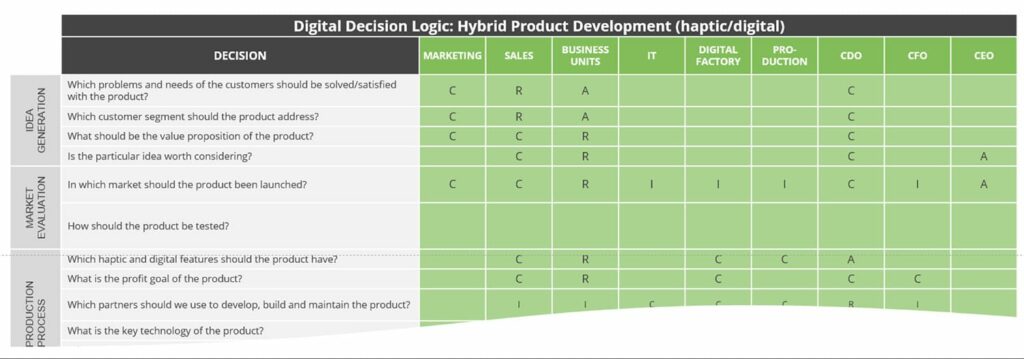

Individual digital innovation level: Startup-like, clear focus, hybrid approach

How an individual innovation is tackled and developed is the make-or-break factor for success vs. disruptive startups. And it is currently the main reason for failure in corporate innovation. Too little focus (“each person runs 5 projects”), too high aspirations (“build the endgame solution right away, not an MVP”), too much management intervention and politics (“who will own it once it’s done?”) and too little actual leverage of corporate resources (e.g. customer access) put corporate innovation in a tough spot, compared to greenfield startups.

While many companies have logically understood how innovation should be approached, practically it is still rarely done in a way that can compete with startups and their ruthless, survival-driven and uncompromising way.

Best practice corporate innovation methodologies like the Corporate Startup Campus are designed not only to resemble startup innovation, but also to leverage corporate resources, know-how, and customer access in a way that startups can’t and, thus, exploit this edge over even the most aggressive startups.

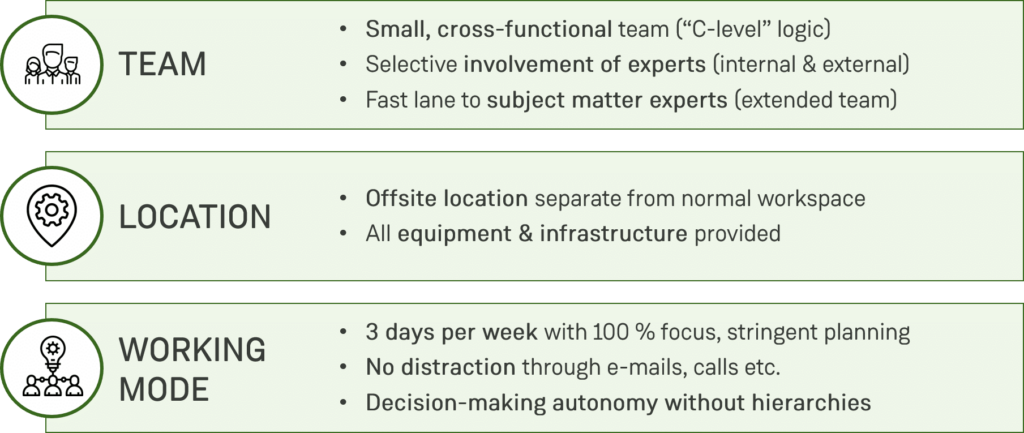

The corporate startup campus builds upon three cornerstones: Team, location, and working mode. If followed through stringently, these enable the most effective creation, validation and scaling of a digital corporate innovation.

Why is this hard? The campus approach forces companies to prioritize more ruthlessly and really focus resources on one topic vs. trying to have key people stretch across many projects in parallel. It requires the best (not the most available) people to be put in charge and grow into a startup-like team. If successful, the team may never return to their former line jobs and instead continue running the corporate startup, which is exactly what the company should make them do. However, this conflicts with the agenda of their (former) line managers who lose valuable resources – just another corporate dilemma that requires smart thinking about management incentivization.

For further reference, we provide a full introduction to the corporate startup campus here:

Excubate Corporate Startup Campus

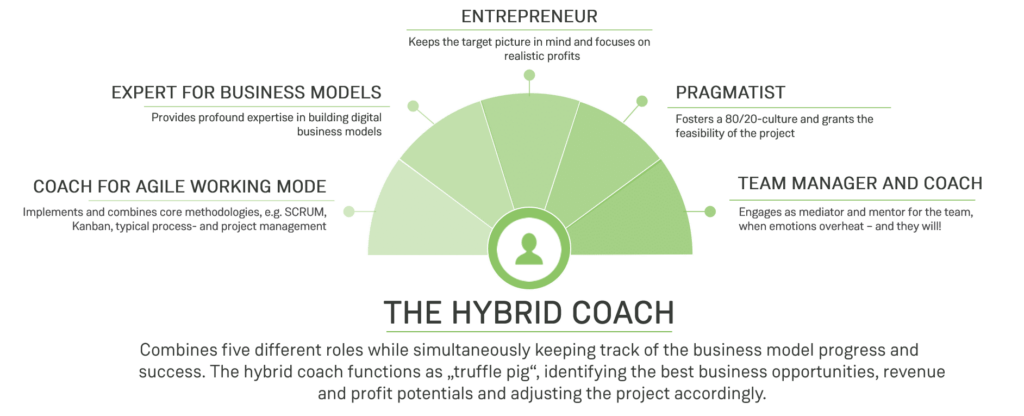

As much as a cross-functional team configuration is an imperative for a corporate startup campus, it requires a catalyst to weld them together as an effective team and fill any capability or capacity gaps that may still be open. The Hybrid Coach was designed by Excubate to do exactly that: Play a multi-faceted entrepreneur-type role to coach and support an initially disjunct group of high-potential employees into a high-performing and self-sustained corporate startup team.

The Hybrid Coach

The Who: Take on a Chief Entrepreneurial Officer mentality

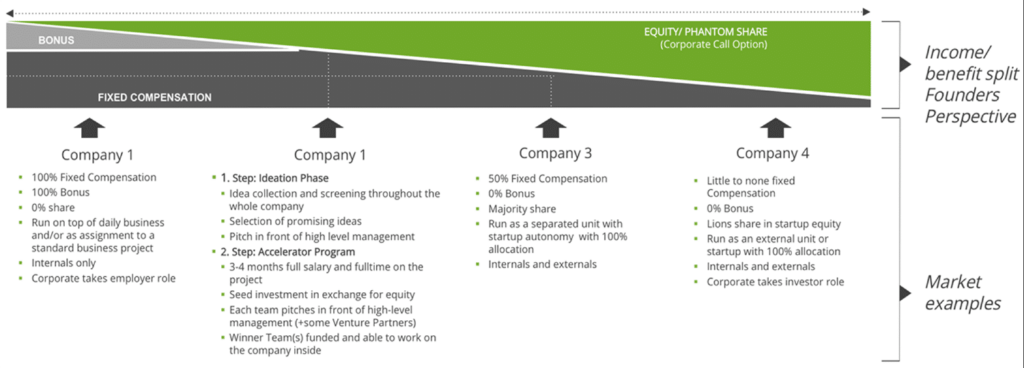

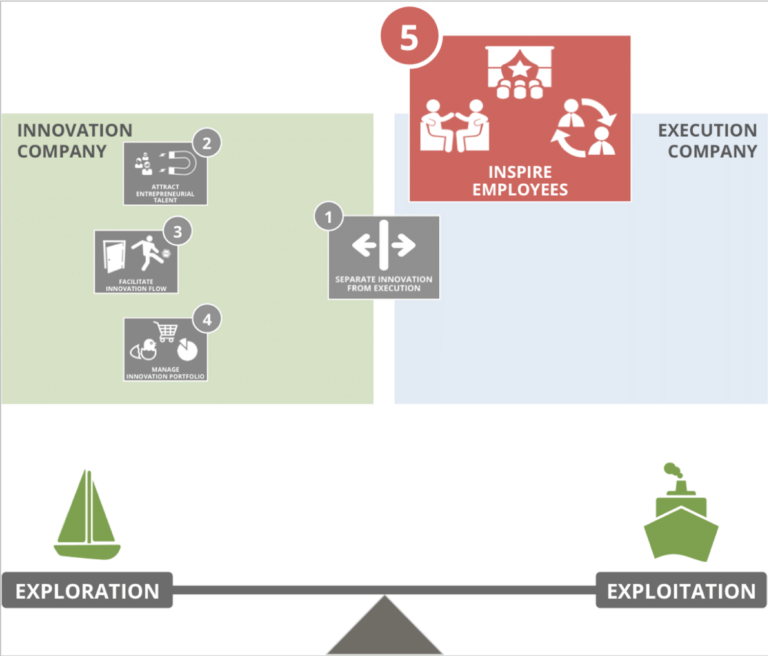

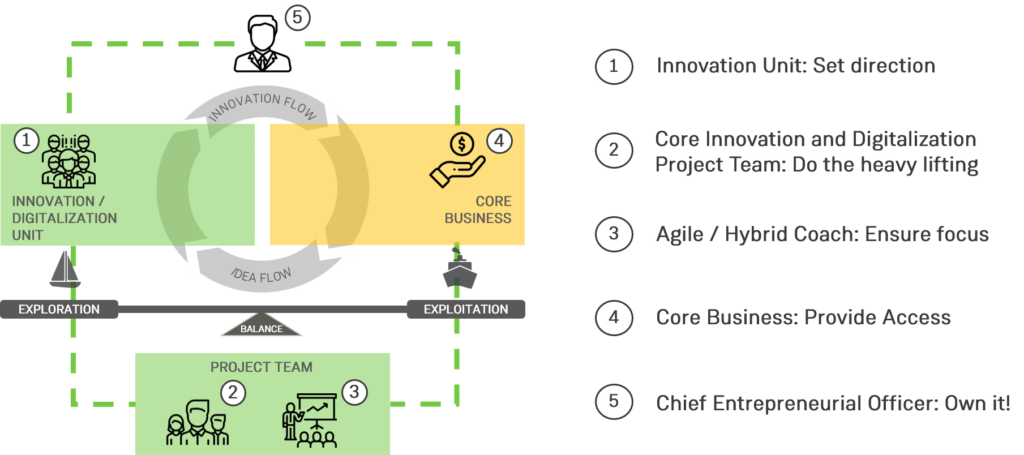

To enable digital innovation success in a corporate, five constituents need to work together and play dedicated, intertwined roles.

The innovation unit (1) sets overall direction, manages the innovation portfolio as well as the innovation funnel and provides resources and methodology guidance to the individual innovation teams. It also “defends” the innovation success against the core business, should it ever have to.

The core innovation project team (2) does the heavy lifting of driving an individual innovation forward and ensures its market success. It will work autonomously enough to make fast progress but will pull resources from the core business when they are needed for success.

Closely working with the core innovation team is the Hybrid Coach (3), ensuring ruthless focus on the innovation goal and supporting the team on a daily basis with methodologies, external input and challenging of the achieved results.

The core business (4) is playing another crucial role without which the innovation team will not have a chance to outperform a greenfield startup: It provides access to corporate resources, primarily customers, technologies, know-how and external partners that are vital for the innovation. At the same time, it must shield the startup team from unnecessary processes and bureaucracy.

Finally, the most important role is the “Chief Entrepreneurial Officer” (5). Supporting the whole innovation construct from the top, only the “CEO” can make sure there is sufficient management attention and priority throughout the hierarchies as well as dedicated innovation resources. Also, the “CEO” needs to protect the innovation unit and individual innovations against external threats like an economic downturn, that only too easily could put a halt to them.

The management or leadership role is one of the most crucial roles and will have to change most significantly in the future. Recent Excubate research on future leadership capabilities has shaped three archetypical roles, a future leader needs to play to enable digital innovation success of their organizations and teams:

- The Innovative Entrepreneur: Visionary, learner, innovator

- The Agile Orchestrator: Catalyst, orchestrator, coach

- The Digital Pioneer: Technology expert, data manager, challenger

For a more thorough view on the future leader, read our Excubate perspective here (in German):

One important trait of a current leader must be the willingness and ability to learn – mostly also from more junior people in their organization. We have summarized our perspective on the Apprentice Leader here:

The Apprentice Leader

Following these guidance points on the what, how and who to innovate, traditional companies have a fair chance to succeed in building digital innovations not only the way greenfield startups are able to do it, but with an even higher chance of long-term success.The difficulty lies within the traditional (leadership) culture of established companies that are not adopting these behaviors very readily and are often stuck in traditional behaviors and incentive structures.

Excubate is an expert for corporate innovation and our team helps build corporate innovation units and individual corporate startups as well as address required cultural change throughout corporate hierarchies. We are excited to discuss your innovation and digital leadership challenge – reach out to us at www.excubate.de.