Why your platform strategy may fail

Summary

Blindly following the platform paradigm may not work as well in the B2B space.

In B2B, additional quality & reliability requirements need to be addressed and the potential moves of industry competitors need to clearly inform your strategy. Just building the next platform business and expecting competitors to jump on it is a risky move and may leave you with a “ghost town” type platform.

Taking a strongly entrepreneurial perspective, building an end-to-end solution with clear value creation and only then extending to a broader platform model may be a promising move that many startups take and that corporates should follow.

The current academic, expert and consultant guidance on why and how platform business models should be pursued is well understood and often discussed. But in B2B, the discussion often misses out on competitive dynamics as a key driver for success and we believe a more differentiated perspective needs to be taken.

Where the discussion is at: You need to become a platform!

There is a lot of well thought through research on platform economics and platform business models that intellectually makes a lot of sense (e.g. the thorough analysis of Parker/van Alstyne/Choudary in “Platform Revolution”) and reinforce the importance of becoming a platform. Also, there are many successful and often cited examples, especially in B2C. Many experts conclude that every “pipeline” business (aka everything older than 5-10 years and however successful), must now become a platform business or otherwise not only lose connection to their customers but miss out on every opportunity for profitable growth and scaling and thus vanish soon.

But as with topics like blockchain, overstretching the platform lingo may have negative effects on the idea itself if suddenly everything is or needs to become a platform – strangely validating the self-fulfilling prophecy that no non-platform business model will prevail. Successful traditional business models are now labelled “platform businesses”, yet may have only little to do with the basic economic idea behind it. A report from the World Economic Forum “Unlocking B2B platform value” even puts companies like AUDI, Monsanto, e.on, Siemens or DHL into the platform business model category. Sometimes even the actual economic logic of a platform is mixed up with a purely technological platform perspective – an Infrastructure-as-a-Service platform is not a platform business model. And more than 25k people on LinkedIn have “platform business” in their job title, many following platforms as a form of millenarianism of economics, i.e. final deliverance from all current economic problems. That may be a romantic, but not fully realistic view.

What the discussion is missing out on: Competitive dynamics

As in B2C, the B2B space is following the notion of becoming a platform business and many paradigms are adopted 1:1 from B2C. However, designing the right platform model and making a margin with it is substantially more difficult in B2B as there are different and additional requirements. Just focusing on network effects as the main driver of value may fall short of B2B reality.

All (B2C and B2B) platforms benefit from general platform success factors like clearly defined and high-volume value units (e.g. room bookings), smart curation mechanisms (e.g. five stars for good behavior), multisided network effects (i.e. more is more) and customer retention levers (e.g. blocking of multi-homing) to name just a few. However, B2B platforms, especially those that offer services, not one-off product sales, may struggle fulfilling a few important requirements:

- Quality assurance, already from the first transaction – puts higher pressure on the curation mechanisms

- Reliability and longer-term availability of services – puts higher pressure on the stability of individual providers

- Efficiency from stability rather than constant switching – puts higher pressure on defining the right value unit

A major pitfall of platform models is the difficulty to ensure quality of components (and their providers) and respective solutions. Recent B2C platform challenges of AirBnB and Uber could be addressed, for example, with respective review-mechanisms. In a B2B scenario, where the relevant service may be critical for business continuity and carry substantial risk for the customer, this is different. Imagine a predictive service offering, composed of multiple components sourced from different providers on a platform that doesn’t deliver because the analysis app from provider A doesn’t work with the data from provider B.

Moves of your competitors should inform your own: How to play to win

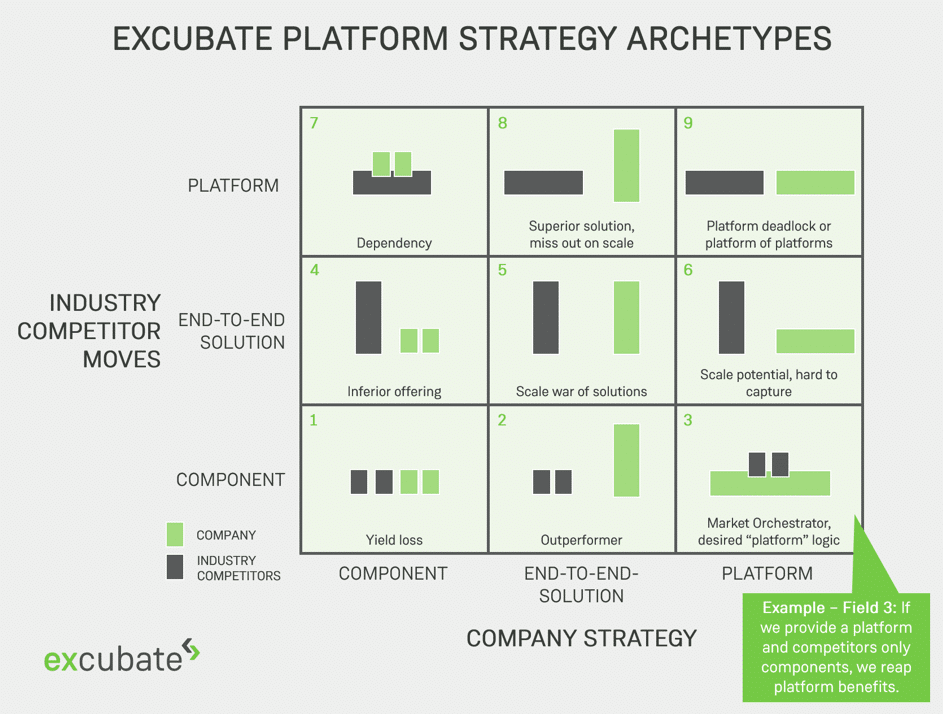

There are essentially three archetypical positions players can take in platform-based B2B value creation that define their competitive potential and positioning:

- Component provider: A specific value adding element that needs to be combined with others to actually deliver value (e.g. payment component)

- End-to-end solution provider: A stable, value delivering solution that integrates (own or third party) components to address a specific customer need (e.g. a predictive analytics solution including sensors, transport, data, analytics and payment)

- (actual) Platform: A market orchestrator hosting 3rd party components to flexibly and frequently combine into end-to-end solutions and provide to customers (e.g. an IIoT platform for the machinery industry)

There are nine potential outcomes when a company chooses its positioning while the competition does the same. Some of these are favorable outcomes, some less so. If all players jump on the platform bandwagon (field 9), nobody will eventually have partners on their platform and all find themselves in a deadlock. If a company chooses to provide components only, it may end up depending on other’s platforms (field 7), and so on.

Not every company can, nor should become a platform. In the IIoT space for example, there are now more than 150 platforms already, according to a recent OliverWyman study (IIoT Platforms: Source of Profit or Inflated Hype?). Most of them are not adding real value yet (aka a field 6 or 9 situation).

It is important for B2B players to first and foremost optimize for customer value creation, which is best created by a stable and reliable end-to-end solution. Even the often cited platform success models Amazon and Facebook started out as an end-to-end solutions for online book selling or social networking before they became a market place or advertising platform. In B2B IIoT terms this could be a predictive service offering focusing on a specific client use case and provided with high service quality and strong value focus. Going for fields 2, 5 or 8 will be the best shot at that, regardless of what the competition will go for. To maximize the platform option value, a field 3 scenario could be prepared in parallel, leveraging an own strong end-to-end solution as a kick-starter and attracting additional component providers.

How does it play out in B2B reality: The GE/Predix vs. Konux example – a “Field 8” situation

It appears like the classic corporate vs. startup stand-off: An industry giant trying to position itself as a large-scale platform player vs. a focused startup with just one specific value proposition. While not disecting the typical corporate issues GE ran into while trying to make GE Digital, and its IIoT platform Predix succesful (this would rather be an Excubation discussion), it is interesting to highlight the platform-specific differences to Konux.

Predix, which has recently been spun off from GE’s struggling digital unit in an attempt to give it more freedom and growth potential, has been following the classical IIoT platform vision early on (see also Navigan research from Sep 2018): Take a substantial investment from GE and build a holistic third party developer platform to combine and provide end-to-end IIoT solutions and dominate the market. A premature marketing push created high expectations while the platform, lacking sufficient breadth of its offering, could not sufficiently deliver. Platform success factors like high customer switching cost turned out risky for customers, fearing they could not migrate their data to another platform. Eventually, many apps on the platform came from GE itself.

Konux, on the other side, started with one very specific use case (AI based improvement of equipment availability), delivered end-to-end (including sensors up to analytics tools) to one industry (railway) and even one specific type of equipment (switches). Konux has been very successfully deploying this system at large railway companies and gained substantial trust from investors, who by now invested more than $50M (as per Crunchbase 02/19). Based on initial success, Konux will be able to extend its solution to further use cases (e.g. tool machinery) and eventually even a platform business model.

This is a field 8 situation with Predix providing a broad platform that is struggling to succeed while being outperformed by an end-to-end solution provider – in the specific use case area that both are eventually competing in. Extrapolating this situation to all use cases covered by Predix, it may not win (sufficient trust) in any.

Key message: Take a differentiated, competitive and value-oriented perspective when implementing a platform strategy

- If everyone is a platform, no one is a platform.

- A platform strategy only pays off if the context of competition and the quality and stability needs of the customer are considered and actually met. Announcing a platform before it actually creates value is dangerous.

- There is value in providing end-to-end solutions that solve real customer problems over building the next best platform model in last-minute-panic. If you have a strong end-to-end capability, relax and build upon that.

- If quality matters, a pipeline model may have an edge over a platform and should be the starting point to eventually develop into a platform (the 2>5>6 strategy)

We have been working together with our clients in the financial services, healthcare, machinery and technology industries to ideate, design, validate and implement B2B platform businesses as well as non-platform end-to-end solutions. If you are working on your own platform strategy, we’d love to invest some time to help you get the best out of it. Start a conversation at innovate@excubate.de and www.excubate.de.