Executive Summary

This article provides a perspective on the current state and future direction of leading automotive nations with regards to two emerging technologies, electric vehicles (EVs) and (semi-)autonomous vehicles (AVs), which we believe will come together (AEVs). Furthermore, this article intends to equip fleet managers with an understanding of challenges and possibilities that arise from these combined technologies and provide guidance on how to prepare now, ensuring ideal positioning and aiding future competitiveness.

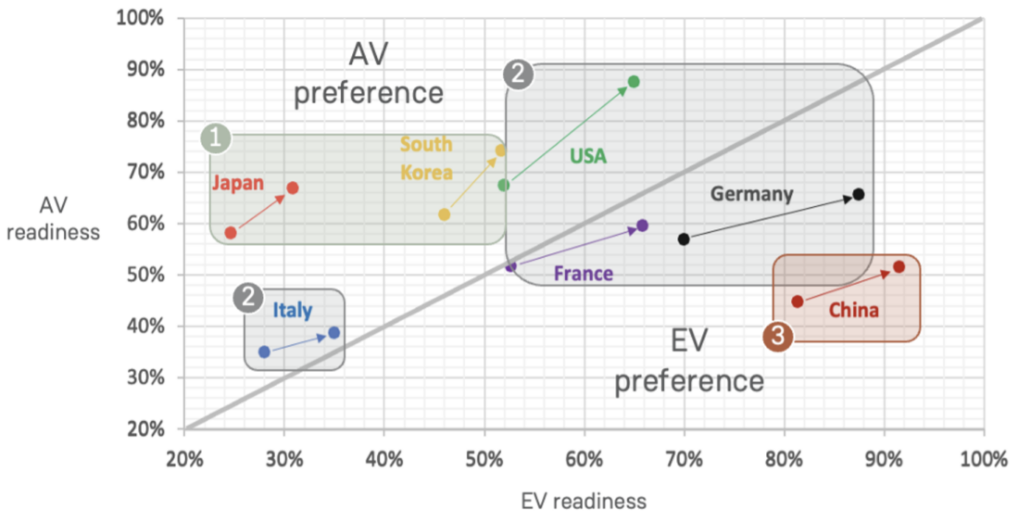

Our research shows that leading countries pursue both technologies but approach them with different focus. Generally, countries can be grouped in three different clusters (1. AV first, 2. EV first, 3. balanced approach). Findings further indicate these technologies will change the nature of fleet managers jobs, shifting it more towards a strategic rather than operational role. Converting their fleet to AEV, fleet managers can expect a higher degree of temporal and spatial flexibility, in-creased importance of fleet to employee effectiveness / productivity, higher degree of fleet utilization and thus decreased fleet size, new forms of commercial engagements with OEMs, and resultingly less operational fleet management tasks and reduced fleet costs. To leverage these benefits, fleet managers must transform their role to a more strategic role, contributing organizations transform and overcome challenges in areas of infrastructure, organization culture and change management (taking employees on the journey), use case and business plan definition.

The autonomous electric vehicle (AEV) – turning point or imperceptive change

Introduction

Both, electric and (semi-)autonomous vehicles, have been under development for several years and are slowly being introduced to the market1. While governments around the world pave the way for accelerated adoption of EVs , aiding their climate targets, automakers drive the launch of AVs to unlock new business opportunities by cooperating with hyperscaler (e.g., Microsoft, Amazon AWS).2, 3

Given the dominance of electrification (no other upcoming tech. is nearly as dominant) and the general trend of automation (OEMs thrive towards automation), we believe these two trends will come together and shape fleets of tomorrow.

While there are insights on both topics in isolation, we believe the convergence raises many questions about associated challenges and business opportunities for fleet managers. Fleet managers need to understand the benefits and limitations AEVs bring and how managing an autonomous, electric fleet substantially differs from a traditional ICV fleet. The complexity of both technologies and associated topics e.g., technological limitations, legal landscapes, infrastructural conditions, user acceptance, and respective underlying drivers lead to uncertainty. This leaves future-oriented fleet managers with ambiguity on specific actions that need to be taken today.

Providing actionable insight on steps that should be taken now, is the objective of this paper.

To effectively do this, the paper examines the status quo of leading automotive nations and provide an outlook of progress to be expected in the coming years (till 2030). It will than provide a perspective of what an AEV future may look like, examine emerging benefits, and lastly identify potential challenges and issues, fleet manager will need to address soon / now.

1: Allianz (2022)

2: Bundesministerium für Umwelt, Naturschutz, nukleare Sicherheit und Verbraucherschutz (2021)

3: Capgemini (2021)

Status quo and 2030 outlook AV & EV based on seven leading automotive nations

While the future (largely electrified and automated fleets) will likely not differ for leading automotive nations, their paths towards this future likely will4. Understanding their paths and likely progress nations will make in years to come is key, as it sets priorities and gives context for actions fleet managers need to take now.

Figure 1 below shows current readiness and expected progress towards AEV until 2030 for the seven leading automotive nations.

4: Further details on the status quo assessment, the projection for the year 2030, and what 100% on each scale imply can be found in the appendix

Figure 1: AV and EV readiness of the seven leading automotive nations

Looking at Figure 1, it can be concluded that every country is different in terms of current state and expected progress to be made. Nonetheless, countries can be grouped in three clusters, based on the likely progress they will make and priorities they set. These cluster are:

- Japan & South Korea, putting clear and sustained focus on AV first (& EV later)

- European countries & the US, looking to develop EV & AV simultaneously (each set a slightly different focus)

- China, with its ambition to become the world’s foremost source of renewable energy, pursuing EV first(& AV later)

Cluster 1: Japan & South Korea: AV first, EV later

The first cluster is formed by Japan and South Korea. Both countries have their strength in autonomous driving and are likely to be late adopters of electromobility.

While both countries do have EV ambitions (e.g., Japan wants 50-70% and South Korea 33% of new cars to be EV (and/or hydrogen in case of Korea) by 2030), their recent adoption, production and innovation track record indicates stagnation of EV readiness and adoption5, leading us to believe that only very moderate progress will be made.

More focus is placed on AV, which will likely progress fast. One indicator is the high number of patents filed for AV technologies by Japan’s automotive OEMs, leading to an optimistic AV development forecast5. Looking at SouthKorea, the government’s strategic plan intends 54% of new cars sold to be AVs working at either level 3 or 4, with 12% working at level 4, by 2030. The government has also formed an alliance to help vehicle and component manufacturers collaborate with technology companies. This intensive governmental support for infrastructure development as well as legislative processes is critical and points to a steep future AV trajectory.6

5: Bernhart W., Riederle, S., Hotz, T. et al. (2021)

6: Threlfall, R., Püstow, M., Ng, Philip et al. (2020)

Cluster 2: Europe and us: EV & AV the same time

European countries and US are taking a balanced approach, pursuing both, or in some cases none of the technologies, simultaneously.

Having a closer look at the European countries and expected EV development, Italy’s readiness and outlook are the weakest of examined European nations and expected to be falling further behind, as neither EV nor AV are prioritized technologies for Italy, as for example demonstrated by the slowly expanding but still rather limited range and variety of Italian EVs7.

France competes with Germany for the pole position in Europe EV market. While both countries have their own strengths in the field of EV (Germany has a wider array of EV models and better range, while France has significantly more battery building capacities8), they are similar in terms of political support and societal willingness. This is for example demonstrated by France’s President E. Macron unveiling a €4 billion investment plan for the country’s transport sector modernization, German government’s commitment to building 15 million EVs (app. 40% of cars currently registered in France) and 1 million charging points by 20309, or 61% of French people being willing to buy an EV as their next car10.

Nonetheless, targets and a generally high pace in Europe are driven by the European Union, which passed a regulation only allowing 0-emission cars (mainly EV) being registered as new cars from 203511. This will force countries, like Italy to pick up momentum and motivate leading nations such as Germany or France to push hard, leading to a generally optimistic outlook for EV readiness and adoption.

As for AVs, the European Union is playing less of a driving role. Here national strengths and weaknesses will dictate the pace of initial development. As such, Italy with its limited political stability and inflated cost of AV technologies, is expected to make initially more moderate gains.

On the other hand, France, being the first nation in Europe to have a comprehensive legal framework for AV, intensified focus on AV related research and leading AV relevant cybersecurity capabilities is expected to progress better. This, however, is hampered to some extent, by the lack of local technology player in France, increasing the need for collaboration with international player, such as Waymo12.

Lastly, Germany shows very high AV innovation capabilities, many AV-related patents, and pioneering work in interaction of microprocessor systems, sensors, and actuators (e.g., Simulytic a Siemens AG venture for AV Simulation).13 Germany is also a role model in terms of industry partnerships and made great strides in licensing and legislation. This, however, is hampered by a relatively low willingness of society to adopt AV technologies and sufficient mobile coverage of its road network14.

Nonetheless, due the EU’s single market, close political collaboration, and cultural homogeneity, we believe all countries, while some earlier (e.g., Germany and France) and some later (e.g., Italy), will follow a similar AV adoption trajectory and progress in terms of readiness and adoption until 2030.

As for the United States, in 2021, President Biden set the target to make 50% of all new vehicles sold in 2030 zero-emissions vehicles. The same initiative also promotes the construction of 0,5 million charging stations for EVs and an investment of 2 trillion dollars in green infrastructure projects. Additionally, financial incentives for consumers as well as carmakers are planned15, leading us to believe EV readiness and adoption will experience further progress, if the current political course is maintained.

In terms of AV, the US is strong in areas of cloud computing, AI, and IoT, all crucial technologies for AVs. Furthermore, technologically advanced AV companies, of which the US has many (e.g., Waymo, Apple, Tesla, and GM) benefit from regulatory support, high capital investment, and widespread consumer acceptance16. Considering these points and the great technology advances the US have already made (Waymo is currently able to operate at Level 4 automation17), we see strong development in AV, sustaining the US leadership in this technology.

7: Bernhart W., Riederle, S., Hotz, T. et al. (2021)

8: Plank, W. (2021)

9: Schaal, S. (2022)

10: Alix, C. (2022)

11: Schaal, S. (2022)

12: Threlfall, R., Püstow, M., Ng, Philip et al. (2020)

13: Simulytic (2022)

14: Threlfall, R., Püstow, M., Ng, Philip et al. (2020)

15: The White House (2021)

16: Threlfall, R., Püstow, M., Ng, Philip et al. (2020)

17: Molla, R. (2021)

Clustera 3: China: EV first, AV later

In contrast to other Asian countries, such as Japan and South Korea, China is an example of EV first and AV later. At current China is the biggest producer for EVs and largest EV market in the world, with roughly 50% of all EVs being build and sold here18. Looking into the future, forecasts suggest that while ICEVs will continue to be the backbone of Chinese mobility, 1/3 of vehicles on the market will be BEVs and PHEVs by 203019. Looking further into the future, however, China’s leadership in EV may decline. This is as China recently imposed a mandate on automakers requiring that EVs need to make up (only) 40% of all sales by 2030.20 Comparing the Chinese mandate with the EU Parliament’s decision, it is to be noted that the EU’s decision is much more ambitious, putting Europe potentially ahead of China.

When it comes to AV, China’s known challenges are the need for accurate digital maps and the development of needed policies and standards. In addition, the Chinese 5G network has yet to prove whether it lives up to its hype21, providing a critical and reliable infrastructure, AVs need. Lastly, foreign automakers are subject to strict regulations when it comes to collecting and storing vehicle data, disincentivizing investments in China and severely hinders domestic development.22 Overall, these reasons impede AV adoption and will likely slow China on its journey towards autonomous driving.

18: Mersch, T. (2021)

19: Gomoll, W., Viehmann, S. (2022)

20: Stauffer, N. W. (2020)

21: Threlfall, R., Püstow, M., Ng, Philip et al. (2020)

22: Kugoth, J. (2022)

Conclusion of outlook

Concluding from the above (for Europe), it is likely that we will see levels of electrification between 30 and 40% and early application with adoption of less than 10% of L4 driving automation, especially in leading countries like Germany. This will give fleet managers the chance to rely in part on AEVs and make some initial experience with such technologies. It will likely also mean that OEMs will have started offering cars and complimentary services in new and innovative ways, enabling fleet managers to reduce complexity and total cost of ownership.

AEVs impact on fleets and role of fleet managers

Now that we have understood, where countries are heading and where Europe will likely be within the next decade, this section looks at the impact AEVs ultimately would have on fleets and the role of fleet managers.

We envision that future corporate vehicle fleets will consist of on-demand autonomous (level 3-5), largely electric passenger cars and trucks for transporting employees and goods. Between the providing and using party Mobility-as-a-Service (MaaS) contracts, in which the using party chooses the vehicle category, model, amount, equipment, and exclusivity (vehicle dedicated to one organization, or shared usage), will be the dominant form of commercial engagement. Apart from charging expenses, all costs will be included in a monthly AEV subscription or pay per use fee, which is composed of the value of the subscribed vehicle, the autopilot subscription, insurances, taxes, maintenances, repairs, etc.

Future AEV scenario: Fleet user

Service employees use a fleet app and declare with sufficient notice they require an AEV of a certain type, on a certain day, at a certain time, for a defined number of hours or prespecified trip(s). The vehicle request is automatically checked for availability and confirmed. At the requested time, the vehicle independently drives up to the employee at designated location. The car is unlocked via phone, the vehicle can do relevant checks/verifications itself and navigates to the desired drop-off location at the client side, potentially even serving as shared transportation between multiple company sites or different companies. Employee can use the travel time to prepare for their client meeting. After dropping off the employee, the vehicle might notice that it is no longer roadworthy due to a component error. No more user fees would be incurred for this vehicle until repaired.

The integrated sensors locate the error, and a Blockchain-based smart contract is triggered. Insurance claims are filed and adjudicated based on sensor data records and conditions determined in the smart contract, thus enabling quicker financial compensation for the providing party. The smart contract also triggers the ordering of spare parts from the workshop, to which the vehicle drives itself, if possible. In return, an alternative AEV is automatically called to the site, replacing the damaged vehicle, ensuring fleet uptime, and picking-up the service employee.

Future AEV scenario: fleet manager

Future fleet managers that enter above-described car subscriptions might be, depending on the AEV-MaaS contract details, exempt from historic operational tasks such as:

- processing accidents and organizing maintenance/repairs

- communicating with insurance companies or other service providers

- registering and deregistering vehicles as the provider is responsible for doing this as part of the subscription

- monitoring legal requirements (e.g., compliance with accident prevention regulations)

- reporting and controlling costs

- scheduling vehicles i.e., determining how many and which vehicles for whom, and for how long

- managing drivers and drivers related tasks (e.g., managing driving licenses, potential license suspensions, …)

Instead, fleet managers would be focusing on more strategic tasks (with a smaller team):

- Identifying suitable strategic partner, who can meet their organizations need with the most attractive offering

- Establishing the right engagement model for their organization (exclusive vs shared fleet)

- Determining the level of outsourcing to / reliance on the OEM (full vs. partial MaaS)

- Negotiating and maintaining relations with one or more strategic partners

- Managing KPIs and SLAs for existing partnerships

- Working out the right level of flexibility (rely freely on actual employee demand) and commitment (predicting usage and committing to basic volume

- Building and comparing business case scenarios to identify the right partner, model, and engagement

- Functioning as change agent in their organizations, enabling employees adapting to new means of transport and vehicle interaction

As such, we expect fleet management capabilities in organizations to become smaller (less staff), but more strategic in nature (closer to C-Level).

Key benefits of AEVs for corporate fleets

Building on the above, this section will provide a perspective on the two likely largest benefits AEV will bring to organizations and their fleet, leveraging Germany as a concrete, yet representative case study for leading nations.

Higher degree of temporal and spatial flexibility

- Reduce transportation times – driver limitations would be eliminated, more direct routes (lesser noise/emission) can be taken, less potential for congestion, and improved ranges (next gen. batterie-prototypes suggest ranges of 1.000+ kilometers24)

- Improve yearly uptime and vehicle utilization – vehicles move independently, enabling one vehicle to service multiple employees, lesser noise/emission reduces limitations imposed by (local) government, and damaged vehicles are replaced immediately

- Generate potential for (increased) revenues from transport services – resulting from higher utilization potential

- Increase scalability/flexibility – independence from driver supply and commercial flexibility

23: Holtermann, F. (2022) 24: Menzel, S. (2022)

Reduced fleet related costs of 25-4025:

Today’s fleets are impacted by a number of cost drivers, which AEV could reduce and in some cases eliminate, reducing fleet related costs by between 25% and 40% depending the organizations reliance on its fleet and nature of business. These cost drivers are:

- Driver – driver dependency would be decreased or eliminated, replacing driver with autonomous capabilities

- Fleet management operations – OEMs would assume operational responsibilities of fleet managers in case of MaaS contracts, and driver related tasks would fall away, reducing the need for larger, operational fleet management teams

- Accidents – Automation would reduce the likelihood of accidents occurring and OEMs may have to assume responsibility for accidents and therefore accident-related costs

- Fuel and vehicle wear – monthly occurring costs per kilometer of EVs are about 20-40% lower than traditional ICEVs26. Autonomous vehicles being able to refuel (and park) when and where it is cheapest, would further increase pot. savings

- GHG quota – reliance on clean energy would reduce costs for GHG quotas and potentially even provide a source of revenue through GHG quota trading27

- Parking – costs and potential damages resulting from parking could be eliminated, as vehicles no longer need to park at destination

In conclusion, AEVs hold two major advantages over traditional non autonomous ICEVs, significant savings in fleet related costs as well as increased temporal and spatial flexibility, resulting in higher efficiency. These advantages yield significant gains for organizations, making timely adoption and strategic preparation imperative to competitiveness and thus success in an AEV world.

Now that we have understood, where countries are heading and where Europe will likely be within the next decade, this section looks at the impact AEVs ultimately would have on fleets and the role of fleet managers

25: Keese, S. (2018)

26: Hägler, M., Wischmeyer, N. (2022)

27: Consult appendix for more information on GHG quota

Action fleet managers need to tackle now to overcome underlying challenges

While the previous chapter explained the fundamental advantages of AEVs when adopted in vehicle fleets. This chapter provides recommendations for fleet managers, further leveraging Germany as a representative case.

Fostering adoption & initiating transformation

While AEV as a combined technology, at the maturity described above is not yet available, fleet managers would be well advised to initiate transformations, adopting partial technologies (such as EV or early adoption of partial AV capabilities) now. This would be beneficial as it would allow fleet managers to make a start on the 5 key challenges, they will need to tackle for AEV:

- Charging infrastructure (multitude of charging infrastructure will be needed at strategic locations)

- Organizational legal frameworks (such as ownership over at-home charging infrastructure, bonus malus system based on CO2 footprint and employee eligibility) 28

- EV fleet operations (adaptation of fleet management solutions, which are needed for EV fleets),

- Employee readiness and buy-in (smaller transformations will yield learnings around change management and getting employees used to change and partial technologies, will aid later adoption)

- Business cases elements (EV transformation will require business cases to be made, which will prepare fleet managers for future AEV business cases, required for decision making)

Achieving the above will take time and getting started earlier on this journey with a lesser transformation, will aid success chances. Therefore, active leadership now and early engagement will be key to success in working with AEV (and maximizing resulting benefits) in the future.

Fostering EV adoption, one practical challenge fleet manager will need to address is the lack of EV availability due to bottlenecks on the part of OEMs, which is currently leading to long waiting times (between 2 and 20 months). The reasons for these are high demand for EVs, the slow conversion of OEM production lines, the ongoing chip/semiconductor shortage and missing components originating from Ukraine. The implication for fleet managers when procuring vehicles is that special equipment and extra requests should be dispensed with wherever possible, as preconfigured leasing vehicles from most brands are usually available immediately or at least much quicker than highly individualized models. In this context, it shows that EVs in novel car subscriptions are often available faster than with purchase or leasing. This has the added benefit of aiding cultural transformation and employee readiness, who are transitioned away from highly personalized “own” company cars and towards transport as a more standardized service.

While EV capabilities, largely due to battery and infrastructure capacities, are still limited, they already provide a feasible option for most people carrying and most good transport fleets. Currently available +500km range on person cars and +350km for e-trucks is sufficient for most business travel/commute and 85% of land transport needs, which comes to 150km or less29. Only heavy duty and long-haul transport are currently not sufficiently solved and less feasible, because of long recharging times and limited suitable charging infrastructure.

Government subsidies, which have historically aided adoption, are also running out, or are being cut back, incentivizing quick action and early adoption now30.

For AV, early adoption is less pressing and feasible, as autonomous driving passenger cars in fleets will remain a niche for the time being and will take years to reach mass adoption. For currently available semi-autonomous driving (level 2-3) the main application area will be the highway since long and monotonous routes without oncoming traffic and passersby are easier to manage for the current state of AI. Automotive OEMs plan initial application tests of self-driving trucks in fleet operations from 2025, primarily on highways and later in inner cities and on federal roads. From 2030, their goal is to be able to realize self-driving trucks as series solutions, which implies that full-time drivers will still be needed until then.31

To gain confidence in this area and build internal knowledge at an early stage, partnerships with automation specialists on automotive OEM side should be pursued and where feasible, pilot projects and driving trials should be sought out. Findings from such engagements will lead to continuous technological improvement and can be incorporated into the OEM’s series production. Whereas fleet managers gain valuable first-hand experience in AV systems, assess automation opportunities, and possibly even receive special conditions in acquisition and use. Special conditions would be particularly beneficial for adoptions, as they could offset initially higher prices/costs, which will be encountered in a novel technology such as AV.

28: Wermke, I. (2022)

29: Liehr, C. (2022)

30: Paulsen, T., Kroher, T. (2022)

31: Enzian, F. (2021)

Conclusion

The composition of corporate fleets is and will keep drastically changing in the years to come and so will the role of a fleet manager.

Both technologies yield significant benefits for commercial fleets and while AEV as a combined and rel. mature technology is still 15+ years away, transformation of corporate fleets is a significant task, which will require action now to ensure ideal positioning/readiness for these technologies in the future.

Adopting existing partial technologies, such as EVs and engaging in relationships with AV driving organizations (such as OEM) is a good way to start preparing now. As transformation, however, will be multidisciplinary (5 key challenges will need to be tackled), C-Level and fleet managers may be well advised to engage external, expert support and identify the right strategy and starting point for them, aid with stakeholder and change management, help evolve company policies and legal frameworks, and identify and engage in the right partnerships.

Appendix

Status quo of AV & EV readiness

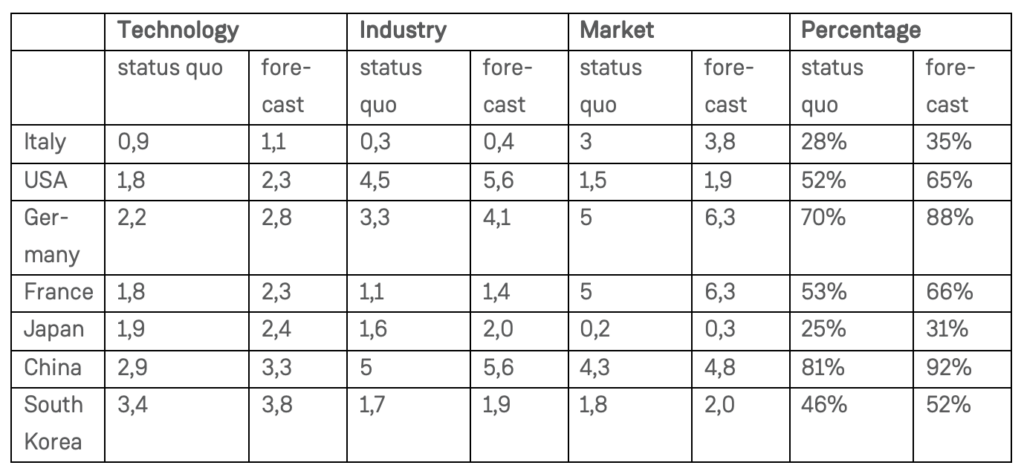

The current level of development in electromobility along the x-axis is based on three indicators. The first indicator is technology, which describes the current state of technological development in EVs made by OEMs in the country in question. The second indicator is industry, which refers to the regional value added in the EVs industry by national production of vehicles, systems, and components. The third indicator is the market, which deals with the size of the domestic market for EVs, based on current customer demand.32

100% on the x-axis would imply that the respective country a) achieved a technological EV development that is as good as or even better than current performance metrics of ICEVs, b) has ambitious political climate reduction targets with meaningful measures that are fully compatible with the Paris agreement, c) has a very significant regional value added in the EV industry by national production of vehicles and components, and d) has a society in which major parts accept and demand EVs.

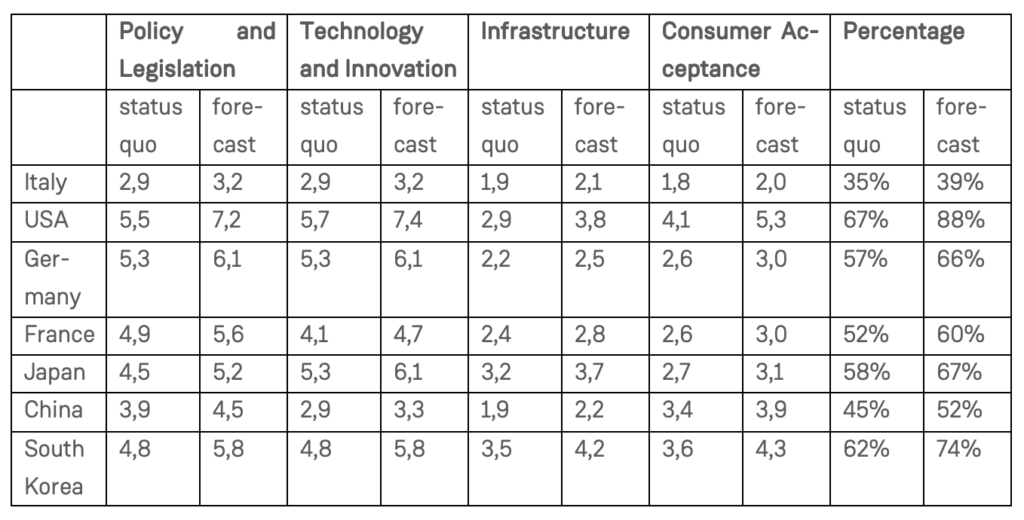

The current level of development in autonomous driving along the y-axis is based on four indicators. The first indicator is policy and legislation which is evaluated by the variables AV regulations, government-funded AV pilots, AV-focused agencies, future orientation of government, efficiency of legal system in challenging regulations, government readiness for change, and data-sharing environment. The second indicator is technology and innovation which is evaluated by the variables industry partnerships, AV technology firm headquarters, AV-related patents, industry investments in AV, availability of the latest technologies, innovation capabilities, cybersecurity, market share of electric cars, and assessment of cloud computing, AI and IoT. The third indicator is infrastructure, which is evaluated by the variables EV charging stations, 4G coverage, quality of roads, technology infrastructure change readiness, mobile connection speed, and broadband. The fourth indicator is consumer acceptance, which is evaluated based on population living near test areas, civil society technology use, consumer ICT adoption, digital skills, individual readiness, and online ride-hailing market penetration.33

100% on the y-axis would imply that the country in question a) has policies and legislation in place that allow level 4-5 AVs, b) has achieved the necessary degree of technology and innovation to enable level 4-5 AVs, c) has established the necessary road and network infrastructure that allows level 4-5 AVs, and d) has a society in which major parts accept and demand level 4-5 AVs.

32: Bernhart W., Riederle, S., Hotz, T. et al. (2021)

33: Threlfall, R., Püstow, M., Ng, Philip et al. (2020)

Projection of AV & EV Readiness

We think that the main influencing factor and first driving force for the future development of the national EV markets are the national and international CO2 emission guidelines for achieving the specified climate targets. If these guidelines did not exist, automakers would continue to market ICEVs as they have in the past. It is likely that the more stringent the emissions guidelines, the more a regional EV market will need to develop to meet the regulations, so underlying variables such as charging infrastructure, consumer demand, and technology development will follow suit. Looking at climate targets as a starting point for the development of each regional EV market, the countries with the most ambitious and binding, yet achievable, climate targets are likely to develop the strongest.

The CAT (Climate Action Tracker) evaluates countries according to policies and actions, domestic targets, fair share targets, and climate financing on a scale from critically insufficient, highly insufficient, insufficient, almost insufficient, and Paris agreement compatible. With this framework it is identified whether: a) government promises for targets and action in its country are ambitious with respect to global least-cost mitigation pathways, acknowledging that most developing countries will need support to achieve this level, b) government promises for action in its country with its own resources and, if relevant, the financing of action abroad represent a fair contribution to global efforts, c) developed country governments are providing sufficient support to developing countries OR developing countries are making plans to use support provided by developed countries, d) governments are putting in place real policies and action in line with global least-cost mitigation pathways or fair share principles and are on track to meeting their promises.34

According to the CAT’s current assessment, the climate measures of the EU, the USA and Japan are insufficient, while the measures of China and South Korea are rated as highly insufficient. Using these assessments of policy directions to project the current level of EVs development into the future, we expect the EU, US, and Japan to develop more strongly, while China and South Korea will develop more slowly by 2030. Germany continues to catch up with China in terms of electromobility.35

Looking at the development of autonomous driving, it differs from the development of electromobility. There is no generally applicable guideline that prescribes the increased use of AVs, for example, to increase road safety. Rather, the driving force is the industry’s desire to capitalize on business potential and gain a competitive advantage by offering its customers the benefit of getting from point A to point B in a convenient and safe manner. Again, the principle of cause and effect applies, i.e., if industry ambitions expressed in investment to support technological AV development are high, other underlying variables such as infrastructure investment, technological innovation, and the regulatory environment will follow to support the desired development. However, actual regional consumer demand and acceptance are non-negligible factors that must be considered in this context.

The AV-related investment assessment refers to the countries of investing organizations, rather than where the investment is made. For the assessment, all AV-related investments listed by Topio Networks and Crunchbase Pro were considered. The consumer acceptance assessment is based on the individual criteria population living near test areas, civil society technology use, consumer ICT adoption and digital skills, individual readiness, and online ride-hailing market penetration. Evaluating the current level of investment in AV technology by each country industry, as well as current consumer acceptance, the following ranking occurs: USA, South Korea, China, Germany, Japan, France, Italy. These evaluations imply that the U.S., as an early adopter in the AV space, is performing better overall than the other countries, providing a favorable basis for strong future development, and maintaining leadership in terms of overall AV adoption.36

34: Climate Action Tracker (2022) [1]

35: Climate Action Tracker (2022) [2]

36: Threlfall, R., Püstow, M., Ng, Philip et al. (2020)

37: Bernhart W., Riederle, S., Hotz, T. et al. (2021)

EV readiness: underlying status quo and forecast assessment37:

AV readiness: underlying status quo and forecast assessment38:

Overview of automated driving levels39:

No automated driving function: The driver is fully responsible for longitudinal guidance (maintaining speed, accelerating, braking) and lateral guidance (steering). There are no intervening systems, only warning ones.

Autonomous level 1 – assisted driving: The assistance system can take over longitudinal activities of the vehicle. This level includes e.g., speed cruise control, adaptive cruise control, brake assistant.

Autonomous level 2 – partially automated driving: In certain situations, the driver can transfer longitudinal as well as lateral guidance to the system. As with level 1, the driver must constantly monitor the system and traffic events and be able to take control of the vehicle immediately at any time. This level includes e.g., overtaking functions, lane keeping assistance and automatic parking.

Autonomous level 3 – highly automated driving: The system fully takes over the driving task, but only in special use cases i.e., on certain routes, for a limited time and when the traffic situation is appropriate (e.g., on highways). The driver can turn away from the traffic and no longer must permanently monitor the system. However, he must be able to resume the driving task when prompted by the system.

Autonomous level 4 – full automation: The vehicle can navigate on almost every route, even in highly complex urban traffic situations, and doesn’t need monitoring from the driver who could theoretically sleep while being in the driver’s seat. If the driving tasks are no longer handled by the system, the driver needs to take over.

Autonomous level 5 – driverless driving: In contrast to Level 3 and 4, fully autonomous driving requires neither driving ability nor a driver’s license – the steering wheel and pedals are therefore dispensable. The vehicle takes over all driving functions on all types of roads, in all speed ranges and environmental conditions. Rides without passengers become possible.

GHG quotas: The legislation stipulates how many tons of CO2 a mineral oil company may emit. For every gram of CO2 that exceeds this reference value, the oil company must pay a penalty. The electric fleet emits fewer CO2 emissions than currently specified by the legislator. If oil companies exceed the reference value, they can make up the difference with the emissions saved by the e-cars, buy the GHG quota and thus avoid penalty payments.

39: BMW (2020)

[A]

Allianz Direct. (2022). Elektroauto-Statistiken. Retrieved from: https://www.allianzdirect.de/zahlen-daten-fakten/elektroauto-statistiken/ [on November 09, 2022] Homepage: https://www.allianzdirect.de/

Alix, C. (2022). When shopping for a new car, French people say they will mainly opt for a hybrid or electric vehicle. Retrieved from: https://www.eib.org/en/press/all/2022-040-when-shopping-for-a-new-car-french-people-say-they-will-mainly-opt-for-a-hybrid-or-electric-vehicle [on June 28, 2022] Homepage: https://www.eib.org/en/index.htm

[B]

Bernhart W., Riederle, S., Hotz, T. et al. (2021). E-Mobility Index 2021. Retrieved from: https://www.rolandberger.com/publications/publication_pdf/roland_berger_e_mobility_index_2021_en.pdf[on June 27, 2022] Homepage: https://www.rolandberger.com/de/

BMW (2020). Die fünf Stufen bis zum autonomen Fahren. Retrieved from: https://www.bmw.com/de/automotive-life/autonomes-fahren.html [on June 28, 2022] Homepage: https://www.bmw.com/de/index.html

Bundesministerium für Umwelt, Naturschutz, nukleare Sicherheit und Verbraucherschutz (2020). Förderung der Elektromobilität. Retrieved from: https://www.bmuv.de/themen/luft-laerm-mobilitaet/verkehr/elektromobilitaet/foerderung#:~:text=F%C3%BCr%20das%20Erreichen%20der%20Klimaziele,Million%20

Ladepunkte%20zur%20Verf%C3%BCgung%20stehen[on November 09 , 2022] Homepage: https://www.bmuv.de/

[C]

Capgemini (2021). Wie Hyperscaler die Autobranche nach vorne bringen. Retrieved from: https://www.capgemini.com/de-de/insights/research/wie-hyperscaler-die-autobranche-nach-vorne-bringen/ [on November 09, 2022] Homepage: https://www.capgemini.com/de-de/

Climate Action Tracker (2022)

[1]. Rating System Overview. Retrieved from: https://climateactiontracker.org/countries/rating-system/[on June 28, 2022] Homepage: https://climateactiontracker.org/

[2]. Country Assessment Overview. Retrieved from: https://climateactiontracker.org/countries/ [on June 28, 2022] Homepage: https://climateactiontracker.org/

[D]

[E]

Enzian, F. (2021). MAN setzt voll auf autonome Lkw. Retrieved from: https://www.mantruckandbus.com/de/innovation/man-setzt-voll-auf-autonome-trucks.html [on July 1, 2021] Homepage: https://www.mantruckandbus.com/de/man.html

[F]

[G]

Gomoll, W., Viehmann, S. (2022). Investitionen ohne Verbote: Warum Chinas Auto-Strategie cleverer ist als die deutsche. Retrieved from: https://www.focus.de/auto/neuheiten/mega-investitionen-statt-gruener-verbote-chinas-pragmatische-auto-strategie_id_51870161.html [on June 28, 2022] Homepage: https://www.focus.de/

[H]

Hägler, M., Wischmeyer, N. (2022). Warum E-Autos jetzt schon oft günstiger sind als Verbrenner. Retrieved from: https://www.sueddeutsche.de/wirtschaft/e-auto-tesla-volkswagen-verbrenner-adac-1.5583505 [on June 29, 2022] Homepage: https://www.sueddeutsche.de/

Holtermann, F. (2022). Darum scheitern Tesla und Mercedes bisher am vollautonomen Fahren. Retrieved from: https://www.handelsblatt.com/technik/autonomes-fahren-darum-scheitern-tesla-und-mercedes-bisher-am-vollautonomen-fahren/28360188.html [on June 29, 2022] Homepage: https://www.handelsblatt.com/

[I]

[J]

[K]

Keese, S. (2018). Autonome Lkw, Digitalisierung und Elektroantrieb verändern Transportwesen und Logistik radikal. Retrieved from: https://www.rolandberger.com/de/Insights/Publications/Lkw-der-Zukunft-Herausforderung-f%C3%BCr-Transportbranche.html [on June 28, 2022] Homepage: https://www.rolandberger.com/de/go

Kugoth, J. (2022). Chinas Datengesetze behindern Entwicklung von Roboterautos. Retrieved from: https://background.tagesspiegel.de/mobilitaet/chinas-datengesetze-behindern-entwicklung-von-roboterautos [on June 29, 2022] Homepage: https://background.tagesspiegel.de/

[L]

Liehr, C. (2022). E-Lkw: Die Ladesäulen sind der Knackpunkt. Retrieved from: https://www.dvz.de/rubriken/land/strasse/detail/news/e-lkw-die-ladesaeulen-sind-der-knackpunkt.html[on June 28, 2022] Homepage: https://www.dvz.de/

[M]

Menzel, S. (2022). VW-Tochter MAN setzt auf reinelektrische Lkw auf der Langstrecke. Retrieved from:https://www.handelsblatt.com/unternehmen/industrie/elektromobilitaet-vw-tochter-man-setzt-auf-reinelektrische-lkw-auf-der-langstrecke/28333636.html#:~:text=Mit%20diesem%20Lkw%20sei%20eine,Batterieantriebs%2C%20auch%20bei%20schweren%20Lastwagen[on June 28, 2022] Homepage: https://www.handelsblatt.com/

Molla, R. (2021). Self-driving cars: The 21st-century trolley problem. Retrieved from:https://www.vox.com/recode/22700022/self-driving-autonomous-cars-trolley-problem-waymo-google-tesla [on June 28, 2022] Homepage: https://www.vox.com/

[N]

[O]

[P]

Paulsen, T., Kroher, T. (2022). Förderung für Elektroautos: Hier gibt es Geld. Retrieved from: https://www.adac.de/rund-ums-fahrzeug/elektromobilitaet/kaufen/foerderung-elektroautos/ [on June 28, 2022] Homepage: https://www.adac.de/

Plank, W. (2021). Milliarden-Plan: Frankreich setzt auf Akkus und E-Autos.Retrieved from: https://www.elektroauto-news.net/2021/milliarden-plan-frankreich-setzt-auf-akkus-und-e-autos [on June 28, 2022] Homepage: https://www.elektroauto-news.net/

[Q]

[R]

[S]

Simulytic (2021).: Homepage: https://simulytic.com/

Stauffer, N. W. (2020). China’s transition to electric vehicles. Retrieved from: https://energy.mit.edu/news/chinas-transition-to-electric-vehicles/ [on June 28, 2022] Homepage: https://energy.mit.edu/

[T]

The White House (2021). President Biden Announces Steps to Drive American Leadership Forward on Clean Cars and Trucks. Retrieved from: https://www.whitehouse.gov/briefing-room/statements-releases/2021/08/05/fact-sheet-president-biden-announces-steps-to-drive-american-leadership-forward-on-clean-cars-and-trucks/ [on June 28, 2022] Homepage: https://www.whitehouse.gov/

Threlfall, R., Püstow, M., Ng, Philip et al. (2020). 2020 Autonomous Vehicles Readiness Index. Retrieved from: https://assets.kpmg/content/dam/kpmg/xx/pdf/2020/07/2020-autonomous-vehicles-readiness-index.pdf [on June 27, 2022] Homepage: https://home.kpmg/de/de/home.html

[U]

[V]

[W]

Wermke, I (2022). Deutschlands Dienstwagen müssen elektrisch werden. Retrieved from: https://www.handelsblatt.com/unternehmen/flottenmanagement/kommentar-deutschlands-dienstwagen-muessen-elektrisch-werden/27912852.html [on June 30, 2022] Homepage: https://www.handelsblatt.com/